Subsequent on the European second section tech funding statistics we reported earlier in the week, we gaze at the analogous data for the U.S. and some attention-grabbing, and stark, comparisons come forward.

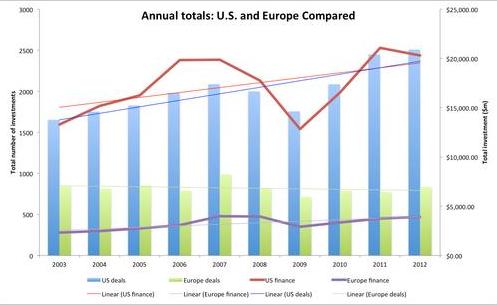

While as you might expect Europe does not compare positively with the U.S. in a like-for-like evaluation, there are signs that things are getting enhanced in Europe, as we reported. Unfortunately, as the figures illustrate, while Europe is improving, the space between Europe and the U.S. is widening.

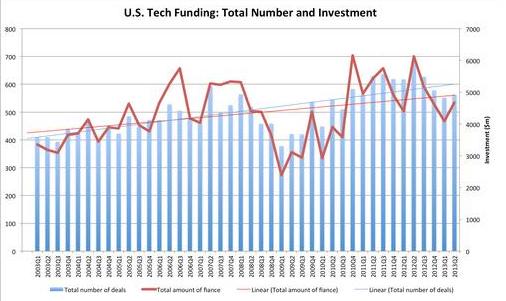

The figures of reported venture capital financings dipped 4%, from 3,506 in 2011 to 3,363 in 2012, even though this gap is to be expected to close subsequent to all deal activity which has been reported. The periodical totals of 838, 940, 852 and 733 dealings in 2012 mainly replicates delayed reporting of a few second-half transactions, but possibly will signal growing investor unease about the approaching fiscal cliff.

Year-over-year, entire venture capital financing profits contracted more stridently than the amount of financings. Proceeds declined 15%, from $35.1 billion in 2011 to $29.7 billion in 2012, even though the quantity raised was still 7% higher than the $27.8 billion in average gross profits for the earlier 10 years, and the year's count is expected to rise more subsequent to all 2012 financings been reported.

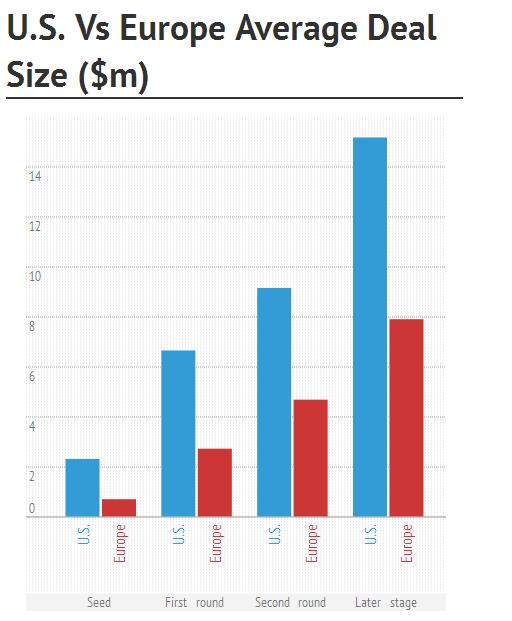

There is a remarkable difference seen among the two markets: U.S. investors place the bulk of their capital into second round deals — i.e. companies with the intention proved they have a marketplace and are generating revenue. By distinction European VCs are more expected to invest mutually in both later phase deals, but also as a proportion of total investments, European investors are putting more of their much lesser chance into the previous, and so riskier, stages.

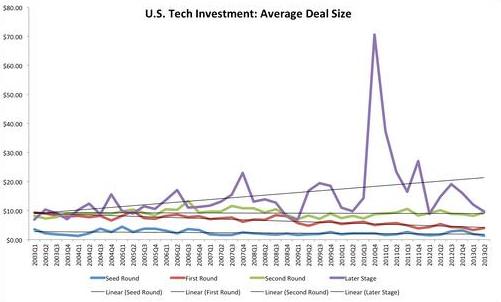

It should be prominent that the average deal size figure is somewhat confusing. This is the 10-year average, and that hides existing changes. So for example, taking just the preceding eight quarters, U.S. first round deals are about 50% smaller ($4.27 million rather than $6.64 million) while European later-stage deals have approximately doubled in size ($7.89 million to $13.45 million).

The most disturbing trend is the direction of the marketplace, the final chart. While in the U.S. both the number of deals, and the total of capital raised are trending upwards, in Europe only the funding is increasing, and at a slower speed than the U.S.

Outlook

Exciting new venture-backed companies ought to carry on to appear in Europe. Negative financial growth is predicted for 2013, on the other hand, and austerity measures are wearing thin on the people, leading to following doubt in some countries. Taken mutually, these factors advise that difficult situation in the European venture capital market are probable to continue for at least the next year.

Leave a Reply: