Can I Afford a $500 Loan? Debt-to-Income and Budget Template

Borrowing $500 may not seem like a big step, but for many households it can make the difference between paying rent, keeping utilities on, or covering an unexpected medical bill. Before taking out a loan, it’s important to evaluate affordability using debt-to-income (DTI) ratios and a practical budget template. EasyFinance.com, a BBB accredited business, helps people access fast, reliable funding through trusted online lenders while ensuring transparency and affordability. With loans up to $2,000 available, EasyFinance gives borrowers more control over financial decisions.

When people search “i need $500 dollars now no credit check,” it shows that financial urgency is common. The key is knowing whether the repayment will fit comfortably within your budget.

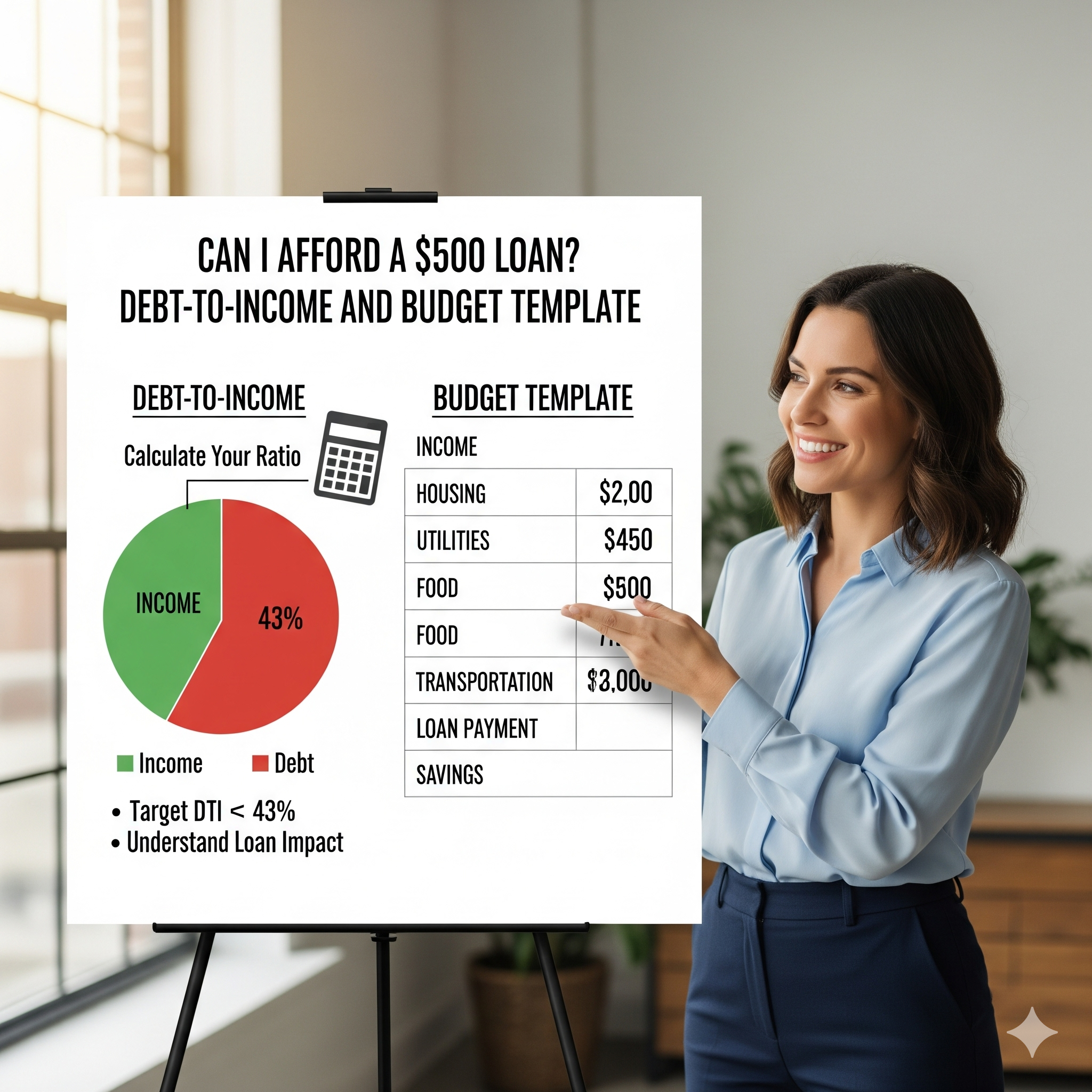

Understanding Debt-to-Income Ratios

Your DTI ratio measures how much of your monthly income goes toward paying debt. Most lenders prefer to see a DTI under 36%, but small-dollar loans are often approved with higher ratios. For example, if you earn $2,500 per month and already pay $1,000 in debts, your DTI is 40%. Adding a 500 payday loan may push that higher, making repayment more difficult.

According to Experian, the average U.S. consumer has a DTI of 30–40%. This highlights the importance of calculating affordability before borrowing.

Budget Template for $500 Loan Repayment

To test affordability, build a simple budget template. List monthly income, subtract fixed expenses like rent, utilities, and car payments, then subtract flexible expenses such as groceries and entertainment. Finally, see how much is left for loan repayment. If you’re considering $500 payday loans online same day, repayment will likely be due within two to four weeks. For installment loans, repayment may stretch over several months.

- Income: $2,500

- Fixed expenses: $1,200

- Flexible expenses: $600

- Remaining balance: $700

In this example, a $500 loan with $75 in fees could be repaid in one month, but only if the borrower cuts other spending or shifts priorities.

Costs of a $500 Loan

Payday lenders typically charge $15–$20 per $100 borrowed, meaning a $500 loan may cost $75–$100 in fees. If rolled over, costs increase quickly. Installment loans may spread costs but often carry higher APRs than personal bank loans. Borrowers seeking $255 payday loans online same day face similar fee structures but with lower loan amounts.

EasyFinance.com helps borrowers compare these costs and find lenders that provide clear repayment schedules without hidden charges.

Alternatives to $500 Loans

Sometimes a smaller or larger loan is the better option. For example, California limits payday loans to $255 payday loans online same day California, while borrowers needing more flexibility may consider a 1000 dollar loan. Installment products allow repayment over several months, reducing the immediate budget impact.

Borrowers often search “i need 1000 dollars now” when recurring bills or larger emergencies arise. EasyFinance provides access to these broader solutions.

No Credit and Income-Based Approvals

One advantage of working with EasyFinance.com is access to lenders offering loans with no credit check. These approvals are often based on income and employment rather than FICO scores. This is especially valuable for borrowers with thin credit files or recent financial challenges.

Other borrowers who think “need cash now” may qualify for same-day deposit options, giving them peace of mind when bills or emergencies cannot wait.

Sample Budget Template

Use this quick template to evaluate whether a $500 loan fits your budget:

| Category | Amount |

|---|---|

| Monthly Income | $2,500 |

| Rent/Mortgage | $1,000 |

| Utilities | $200 |

| Groceries | $400 |

| Transportation | $250 |

| Other Expenses | $350 |

| Available for Loan Repayment | $300 |

This example shows that repaying a $500 loan in a single month may strain the budget, but an installment structure could make repayment manageable.

Trends in 2025

Small-dollar loans remain in high demand. Recent surveys show 37% of Americans cannot cover a $500 emergency from savings, making short-term lending essential. Online lenders, including those partnered with EasyFinance.com, are offering faster approvals and lower fees compared to traditional storefront payday lenders. Demand is especially strong among gig workers, students, and families facing rising living costs.

Key Insights

- Debt-to-income ratios are the best starting point for assessing affordability of a $500 loan.

- A simple budget template helps determine whether repayment is realistic without sacrificing essentials.

- Payday loans provide fast access but come with high costs if rolled over.

- State rules, such as limits on $255 payday loan products, impact what borrowers can access.

- Installment loans and larger options like a $1,000 quick loan no credit check may offer better repayment flexibility.

- No-credit-check lenders expand access for borrowers who otherwise would be denied.

- EasyFinance.com provides transparency and connects borrowers with reputable lenders, making sure they receive the best possible offers.

FAQ

- What DTI ratio should I have to afford a $500 loan?

- Ideally under 36%, but many small-dollar lenders approve borrowers with higher ratios if income is steady.

- Can I get a $500 loan without a credit check?

- Yes, options like $500 cash advance no credit check are available.

- What if I only need a smaller loan?

- States like California cap payday loans at $255 payday loans online.

- Can I get larger amounts if $500 is not enough?

- Yes, many borrowers choose a i need $1,000 dollars now no credit check option for bigger expenses.

- How fast can I get the funds?

- Many lenders connected through EasyFinance.com offer same-day approval and direct deposit.

- Do lenders consider my budget?

- Some do, but using a personal budget template helps you avoid overborrowing.

- How does EasyFinance.com help?

- By comparing offers from multiple lenders, EasyFinance ensures you secure the most affordable and transparent borrowing option for your needs.

Disclaimer: EasyFinance.com is not a direct lender. We connect borrowers with licensed online lenders offering loans up to $2,000. Always review loan terms and conditions before applying.

$500 Loans Related Articles

- $500 Loans: How to Get a $500 Loan Online Today

- $500 Installment Loans Online

- $500 Loans for Bad Credit

- $500 Loan No Hard Credit Check Alternatives

- Compare $300 vs $500 vs $700 Loans: Costs, Speed, and Approval Odds

- Same Day $500 Loans: Cutoff Times, Direct Deposit, and Cards

- Weekend and Holiday $500 Loans

- Instant $500 Loans to Prepaid and Debit Cards

- $500 Loans Without a Bank Account: Cash Pickup and Card Options

- $500 Loan for Emergency Expenses

- $500 Loan for Rent or Utilities

- $500 Loan for Car Repairs

- $500 Loan for Medical Bills

- $500 Loans for Gig Workers and 1099 Earners

- $500 Loans While Unemployed

- $500 Loans on SSI and SSDI

- $500 Loans for Students

- $500 Loans for Single Parents

- $500 Loans for Military and Veterans

- Approval Odds for a $500 Loan by Credit Score Band

- Documents You Need for a $500 Loan

- $500 Loans Without a Cosigner: Realistic Paths

- Soft Pull vs Hard Pull for $500 Loans

- True Cost of a $500 Loan: APR vs Fees, Example Repayments

- $500 Payday vs $500 Installment vs Credit Builder Loan

- Can I Afford a $500 Loan? Debt-to-Income and Budget Template

- Early Payoff and Extensions on a $500 Loan

- Best $500 Loan Apps for Fast Funding