$500 Payday Loan vs $500 Installment Loan: Which Costs Less?

When you are facing a sudden financial emergency, a $500 loan can feel like a lifeline. But should you choose a payday loan or an installment loan? The costs, repayment structure, and accessibility differ significantly, and the choice you make can affect your financial stability. EasyFinance.com, a BBB accredited business, connects borrowers with trusted lenders offering both payday and installment loans online. Understanding the differences will help you make a smarter borrowing decision and secure the most affordable option for your situation.

What Is a $500 Payday Loan?

A $500 payday loan is a short-term advance typically designed to be repaid on your next paycheck. These loans are fast and convenient, with approvals often within minutes. Borrowers who search for $500 cash advance no credit check options are usually looking for quick access to funds without the hurdles of traditional banking. While convenient, payday loans often carry higher APRs because they are short-term and unsecured.

What Is a $500 Installment Loan?

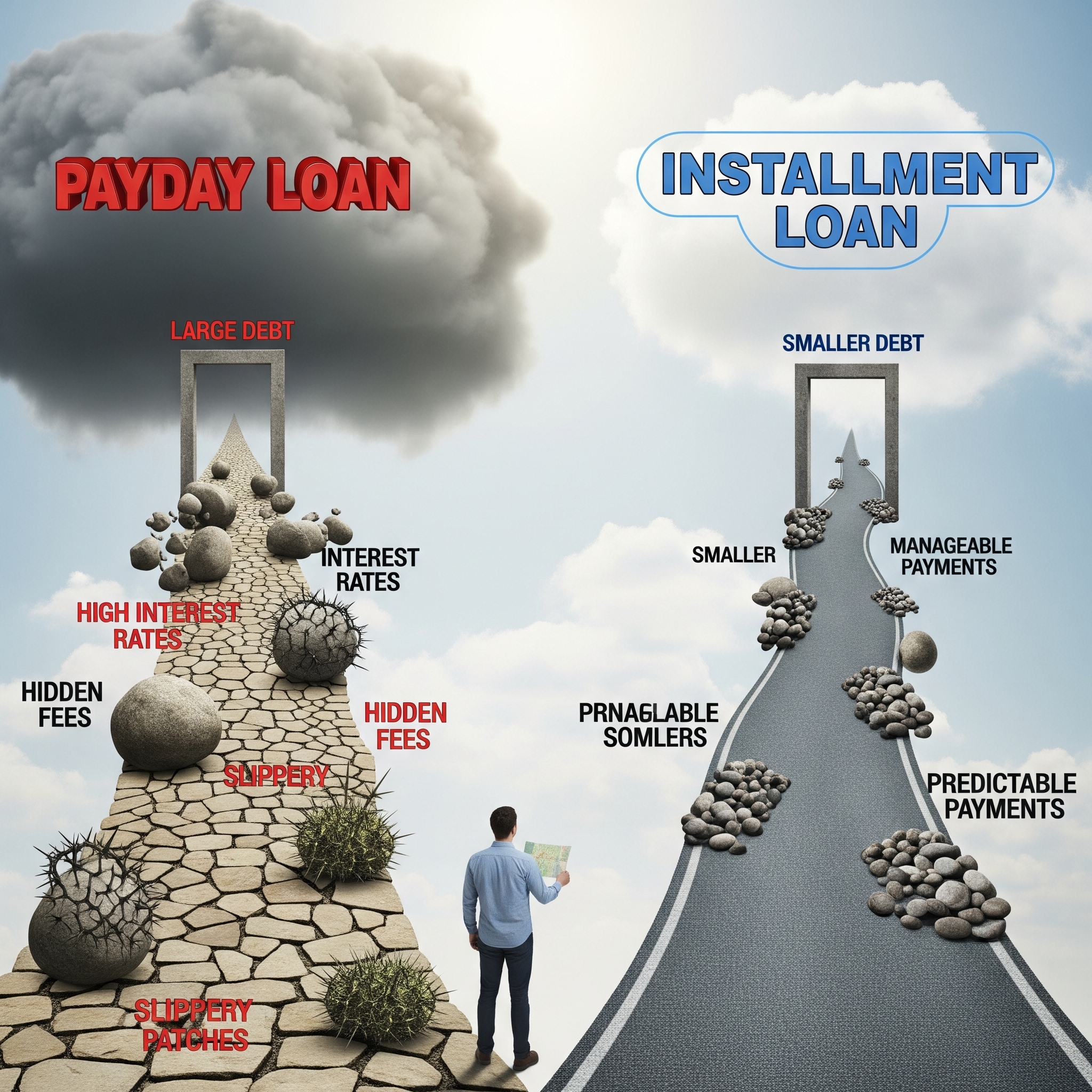

An installment loan allows you to borrow $500 and repay it over several months in equal payments. Instead of one lump sum, you can spread the cost over time, which makes it easier to manage alongside regular bills. Many borrowers compare 500 payday loan offers with installment loans to evaluate which repayment method best fits their budget. Installment loans usually have lower effective costs compared to payday loans, though repayment terms may extend longer.

Comparing Costs and APR

The biggest difference between payday and installment loans lies in the total repayment amount. A payday loan of $500 could come with a fee of $75 to $125, which translates into an APR well over 300%. In contrast, a $500 installment loan may have a lower APR if spread across three to six months, but the total interest paid could still be significant. EasyFinance.com helps borrowers compare options like $500 payday loans online same day and longer installment options to find the lowest-cost path.

When Speed Matters Most

One reason payday loans remain popular is speed. People searching phrases like i need $500 dollars now no credit check often need money the same day, and payday loans usually deliver. Installment loans may also offer fast approval, but sometimes the deposit can take an extra day. EasyFinance.com works with lenders who can fund both payday and installment loans quickly, giving borrowers flexible choices for urgent needs.

Repayment Flexibility

A $500 payday loan is due in a lump sum, which can create repayment strain. Many borrowers find themselves rolling over the loan, leading to higher costs. On the other hand, installment loans allow structured repayment in smaller monthly amounts. For example, spreading a $500 installment loan over four months results in smaller, more manageable payments. Borrowers interested in $255 payday loan options often face similar decisions, but the advantage of installment loans is predictability and reduced rollover risk.

Credit Impact and Accessibility

Both payday and installment loans are accessible to borrowers with limited or poor credit histories. Many lenders do not require a hard credit check, which is why options like no credit check loan are so popular. Installment loans may sometimes report to credit bureaus, helping responsible borrowers rebuild credit over time. Payday loans typically do not improve credit history, but they can still provide quick solutions in emergencies.

Borrower Profiles: Who Benefits Most?

Payday loans are best for borrowers who can repay in full within a few weeks and prioritize speed. Installment loans are better suited for those who need a longer repayment period and want predictable payments. For example, someone facing a one-time medical bill might benefit from a $500 installment loan, while someone who just needs to bridge a two-week gap until payday may prefer a payday loan. EasyFinance.com makes it easier to evaluate both options side by side.

2026 Loan Market Trends

Data from consumer lending reports shows a shift in 2026 toward installment loans, even for small amounts like $500. Consumers increasingly want flexibility, and lenders have responded with lower APR installment products. At the same time, payday loans remain popular for urgent needs. Searches like need cash now and get cash fast continue to drive demand. EasyFinance.com partners with online lenders that meet both needs, ensuring borrowers get the best offers available.

Risk Considerations

While payday loans provide immediate relief, the rollover risk makes them expensive if not repaid on time. Installment loans, while safer for repayment, may carry fees if you miss payments. The key is to borrow only what you can realistically repay. Whether choosing i need 1000 dollars now or sticking with $500, borrowers should always compare repayment schedules, APR, and lender policies before applying.

Key Insights

- $500 payday loans cost more in APR terms, but they provide faster access to cash.

- $500 installment loans spread costs over time, reducing repayment stress.

- EasyFinance.com connects borrowers with both payday and installment lenders online.

- In 2026 installment loans are gaining popularity due to repayment flexibility.

- The best loan depends on your specific emergency and repayment capacity.

FAQ

Which costs less: a $500 payday loan or a $500 installment loan?

Generally, a $500 installment loan costs less overall because it avoids high payday loan fees, but the best choice depends on repayment ability and urgency.

Can I get either loan with no credit check?

Yes. Many lenders offer loans with no credit check, available through EasyFinance.com.

How fast can I get approved?

Most payday loans offer instant approval, while installment loans may take a few extra hours. Both options can often provide same-day deposits.

What if I need less than $500?

You can find smaller options like $255 payday loans online for smaller emergencies.

Do installment loans build credit?

Some installment loans report to credit bureaus, helping improve credit scores with on-time payments. Payday loans usually do not.

Is EasyFinance.com safe?

Yes. EasyFinance.com is a BBB accredited business that works only with trusted lenders to connect borrowers with safe and reliable loan offers.

Can I use either loan for emergencies like rent or car repairs?

Yes. Borrowers often use these loans to cover essential expenses when they i need money now, whether it’s rent, medical bills, or urgent car repairs.

Related Articles

- $500 Loan Online: How to Get Approved Fast in 2025

- Guaranteed Approval $500 Loans: What’s Real and What’s Hype

- No Credit Check $500 Loans: Your Options Explained

- Same Day $500 Loan for Emergencies: Complete Guide

- Best $500 Loan Offers Online: Compare Lenders and Rates

- Can I Get a $500 Loan With Bad Credit?

- Do I Need Collateral for a $500 Loan?

- What APR to Expect on a $500 Loan in 2025

- How Fast Can I Get a $500 Loan Deposited in My Bank Account?

- Are $500 Payday Loans Safer Than Online Installment Loans?

- Best Alternatives to a $500 Loan: Credit Cards, Borrowing Apps, and Advances

- $500 Loan vs $1000 Loan: Which Is Better for Emergencies?

- $500 Payday Loan vs $500 Installment Loan: Which Costs Less?

- Cash Advance vs $500 Online Loan: What’s the Difference?

- $500 Loan from a Bank vs Direct Lender: Pros and Cons

- $500 Loan Online in Texas: Rules and Options

- How to Get a $500 Loan in California with No Credit Check

- Best $500 Loan Options in Florida for 2025

- Can You Get a $500 Loan Same Day in New York?

- When Should You Use a $500 Loan for Bills and Expenses?

- Smart Ways to Repay a $500 Loan Without Extra Fees

- The Risks of Relying on $500 Payday Loans Too Often

- How to Budget After Taking a $500 Loan

- Emergency Situations Where a $500 Loan Makes Sense