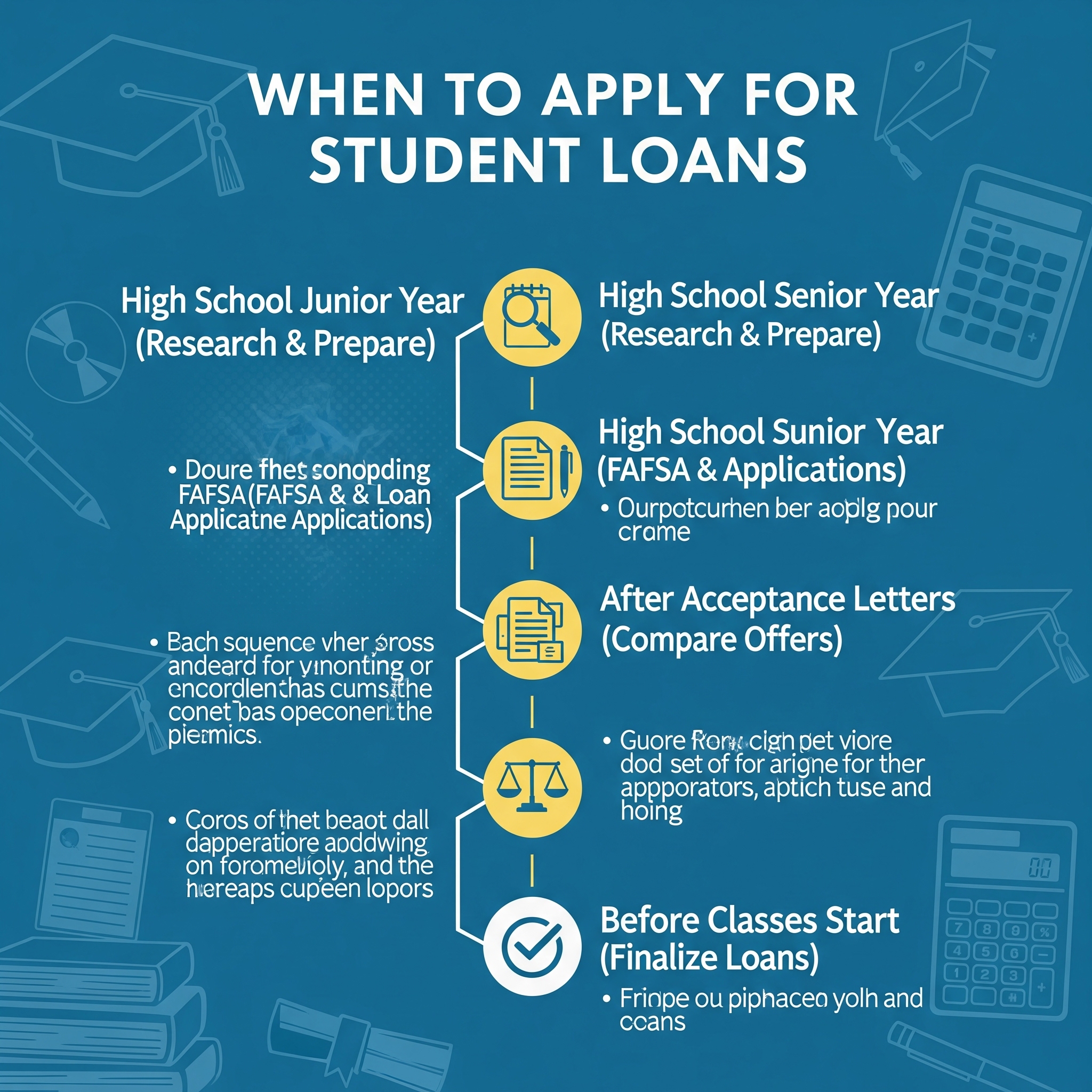

When to Apply for Student Loans

Planning the right time to apply for student loans can make a huge difference in approval chances, interest rates, and funding availability. Whether you are preparing for nursing school, graduate studies, or community college, understanding the application timeline helps avoid last-minute stress. EasyFinance.com, a BBB-accredited business, connects students with the best lenders for 2026, ensuring borrowers secure affordable financing at the right time.

Applying for student loans too late can leave students with limited options or delayed funding. According to a 2024 report from Sallie Mae, nearly 34% of students missed early loan application windows, forcing them into higher-rate options. The best approach is to apply early, compare offers, and lock in favorable terms with help from EasyFinance.com. For students with credit challenges, timing is even more critical, since some lenders require additional review for private student loans bad credit.

Federal loans should be applied for as soon as the FAFSA opens, typically on October 1 each year. Applying early increases the chances of receiving subsidized loans and grants. While federal loans are often the first step, they may not cover the full cost of attendance, especially for private universities or graduate programs.

Private loans can be applied for at any time, but experts recommend starting the process 2 to 3 months before tuition is due. This allows lenders enough time for approval, co-signer verification, and disbursement. EasyFinance.com helps students compare lenders that specialize in best student loans, ensuring faster approvals and competitive rates.

Most students qualify for better rates when applying with a co-signer. Data from College Ave shows that students with co-signers are four times more likely to be approved compared to those applying alone. For students who may need private student loans for bad credit, adding a co-signer can be the difference between approval and denial.

Using EasyFinance.com makes it easier to coordinate timelines and avoid last-minute application stress.

Offers co-signer release after 36 months of on-time payments and covers up to 100% of school-certified costs.

Provides multiple repayment options and flexible funding for undergraduate and graduate students, including those needing how to get student loans when credit is bad.

Covers the full cost of attendance and includes career coaching support for borrowers.

Allows comparison across multiple lenders with one application, without impacting your credit score.

Provides flexible repayment plans and lets borrowers skip one payment per year once repayment begins.

To improve approval odds, students should apply early, gather necessary documentation, and consider co-signer support. EasyFinance.com also works with lenders that provide easy loans for students, making financing accessible even for first-time borrowers.

Federal loans are usually disbursed directly to the school before each semester. Private loan funding timelines vary, but most lenders supported by EasyFinance.com can process applications in 2 to 4 weeks. Students applying for student loans for bad credit may experience longer processing times, making early applications even more important.

As early as October 1, when FAFSA opens. The earlier you apply, the more aid you may receive.

Apply 2–3 months before your tuition is due to allow time for approval and disbursement.

Yes. With EasyFinance.com, many lenders offer options for bad credit student loans, especially if you apply with a co-signer.

Yes. Most lenders send loan funds straight to the institution to cover tuition and fees.

EasyFinance.com is BBB-accredited and helps students compare multiple lenders, ensuring they secure affordable, fast, and reliable funding tailored to their needs.

Why Timing Matters for Student Loans

When to Apply for Federal Student Loans

When to Apply for Private Student Loans

Applying for Loans With a Co-Signer

Best Times of Year to Apply

Top Private Lenders for 2026

College Ave

Sallie Mae

SoFi

Credible

Earnest

Strategies to Improve Approval Chances

How Long Does It Take to Receive Funds?

Key Insights

FAQ

When should I apply for federal student loans?

How soon should I apply for private loans?

Can I apply for loans if I have bad credit?

Do loan funds go directly to my school?

Why should I use EasyFinance.com?