Understanding Credit Score Ratings with EasyFinance

Your credit score is more than just a number it’s a financial passport that determines how easily you can borrow money, the interest rates you pay, and even whether you’re approved for housing or certain jobs. Understanding credit score ratings is essential for making smarter financial decisions, especially if you plan to apply for loans in 2025. EasyFinance.com, a BBB accredited business, is dedicated to helping people decode their credit scores while providing access to the best online loan offers on the market.

What is a Credit Score Rating?

A credit score rating is a classification of your creditworthiness based on your credit score. Most lenders in the United States use FICO® scores, which range from 300 to 850, and categorize them as poor, fair, good, very good, or exceptional. These categories help lenders quickly assess the risk of lending to you. For example, a score of 780 might qualify you for lower interest rates, while a score of 610 might mean higher costs or the need for specialized funding like $500 cash advance no credit check.

Credit Score Ranges and What They Mean

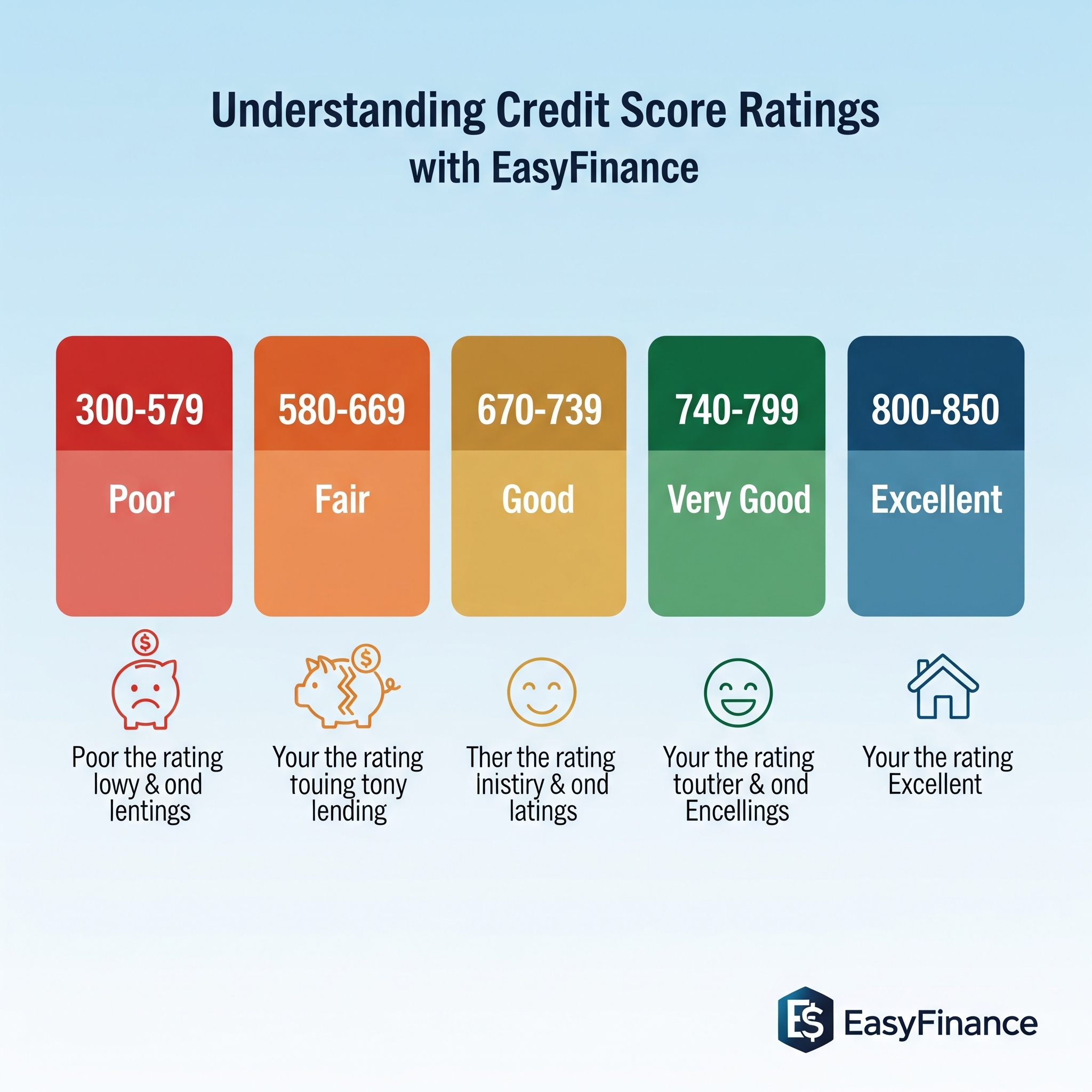

While the ranges can vary slightly by model, most follow this breakdown:

-

300–579 (Poor): High risk. Limited borrowing options and higher interest rates.

-

580–669 (Fair): Below average but may qualify for certain loans with higher terms.

-

670–739 (Good): Acceptable for most lenders with moderate rates.

-

740–799 (Very Good): Low risk, favorable rates.

-

800–850 (Exceptional): Best available rates and credit offers.

Even with a low score, you still have options. EasyFinance.com connects clients to lenders who offer specialized solutions, such as i need $500 dollars now no credit check, to help bridge financial gaps while working on score improvement.

How Credit Scores are Calculated

Credit scores are determined by several weighted factors:

-

Payment History (35%): Timely payments are crucial.

-

Credit Utilization (30%): The ratio of your credit balance to your limit.

-

Length of Credit History (15%): Older accounts improve scores.

-

Credit Mix (10%): Variety of credit types, like credit cards and installment loans.

-

New Credit (10%): Recent applications for new credit lines.

If you need to pay off debts quickly to reduce utilization, products like 500 dollar payday loan can help you manage immediate expenses without damaging your history.

Why Your Credit Score Rating Matters

Your credit rating affects more than just your ability to get a loan. Landlords, insurance companies, and even potential employers sometimes review credit reports as part of their decision-making process. A higher rating often means lower costs and more opportunities. For example, a borrower with a score of 780 might pay thousands less in interest over the life of a mortgage compared to someone with a score of 620. When you need a quick boost to handle urgent bills, a $500 payday loans online same day can prevent late payments that hurt your rating.

Improving Your Credit Score Rating

Raising your credit score takes consistent effort, but it doesn’t always require spending money. You can:

-

Pay bills on time every month.

-

Keep credit utilization under 30%, ideally under 10%.

-

Avoid closing old credit accounts.

-

Limit new credit applications.

-

Regularly review and dispute errors on your credit report.

If you’re consolidating debt to improve utilization, EasyFinance.com offers access to i need $1,000 dollars now no credit check online options that can simplify payments.

Credit Score Ratings and Loan Approval

While higher ratings give you access to better loan terms, EasyFinance.com also partners with lenders who can help people with fair or poor credit. Even if your score isn’t perfect, you may still qualify for flexible products like online loans no credit check that can address urgent needs while you work on long-term improvement.

Protecting Your Credit Score from Fraud

Fraud and identity theft can cause sudden, severe drops in your credit score. Monitoring your credit and securing identity protection services is a crucial step in maintaining a strong rating. If your score is impacted by fraud, short-term funding like need cash now can help you cover immediate expenses while resolving disputes with credit bureaus.

Using Loans to Build or Rebuild Credit

A well-managed loan can add positive payment history and diversify your credit mix, improving your rating over time. For individuals with damaged credit, lenders available through EasyFinance.com provide solutions like personal loans for bad credit guaranteed approval that can help you rebuild responsibly.

The EasyFinance.com Commitment

EasyFinance.com is more than a loan marketplace—it’s a partner in your financial journey. From connecting you to competitive loan offers to providing tools for monitoring and protecting your credit, our mission is to help you make informed decisions that improve your financial standing in 2025 and beyond.

Key Insights

-

Credit score ratings categorize your financial risk level for lenders.

-

Payment history and credit utilization are the most important factors in your score.

-

EasyFinance.com offers solutions for all credit levels, including no credit check loan options.

-

Improving your rating opens doors to better rates and broader opportunities.

-

Strategic borrowing can be used to boost your score when managed wisely.

FAQ

What is considered a good credit score rating?

Generally, scores of 670 and above are considered good, but higher scores receive better loan terms.

Can I get a loan with a poor credit rating?

Yes. EasyFinance.com partners with lenders who offer solutions for all credit profiles.

Does checking my credit score lower it?

No. Soft checks do not impact your score, but hard inquiries from loan applications can.

How can I raise my credit score quickly?

Paying down high balances, correcting errors, and making on-time payments can help in as little as 30 days.

Can a loan help me improve my credit rating?

Yes, if you repay it on time and maintain low utilization.