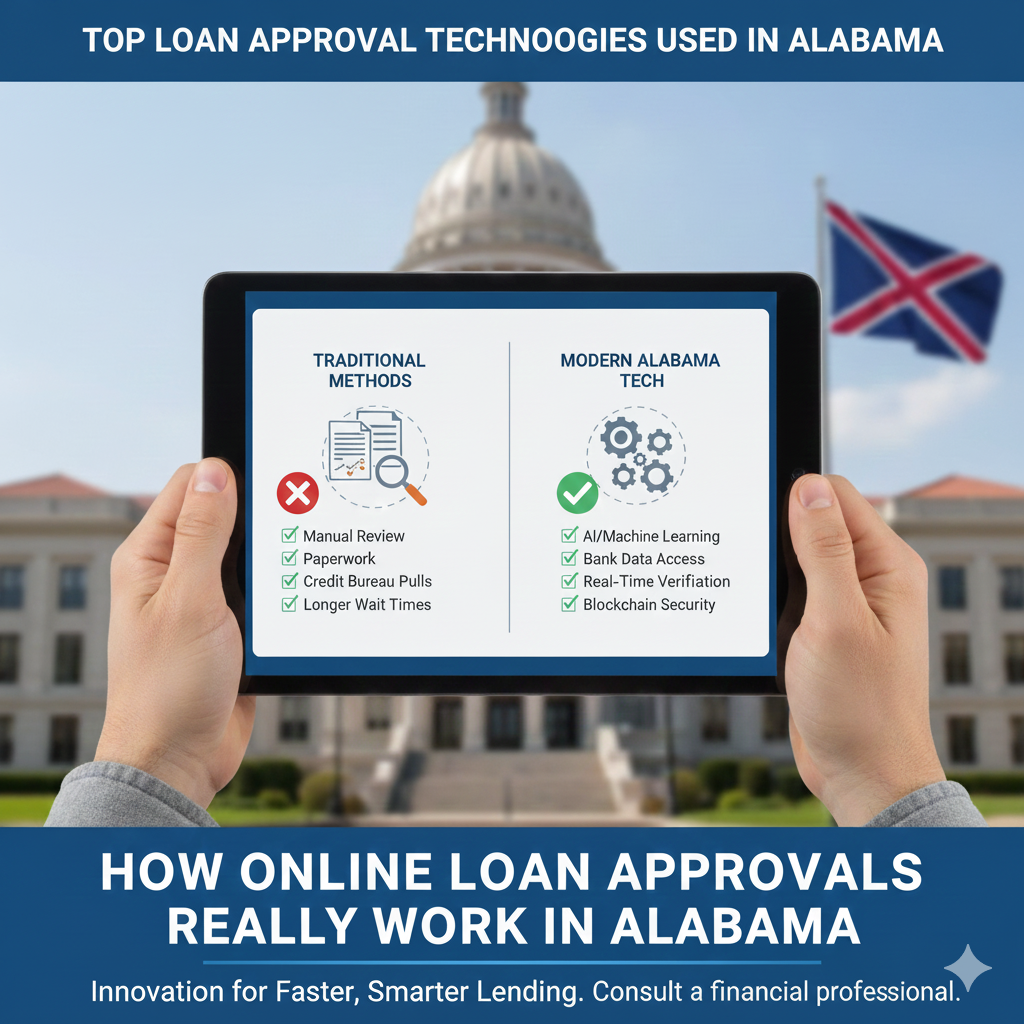

Top Loan Approval Technologies Used in Alabama

Online lending in Alabama has shifted dramatically in the past decade, driven by automation, verification APIs, fraud-prevention stacks, and budget-aware underwriting. Borrowers who need 300 to 2,000 dollars for emergencies increasingly encounter lending decisions powered by data rather than a paper interview. The safest and fastest way to tap offers for up to 2,000 dollars is through EasyFinance.com, a trusted BBB-accredited marketplace that uses secure matching rails to connect Alabama residents to licensed lenders.

Approval systems in Alabama blend traditional credit assessment with alternative financial technologies that evaluate identity, income streams, and deposit cadence. Many lenders start with a soft pull or bank-driven verification literacy rather than an immediate hard credit inquiry. But before any lender issues moderate principal above the 500-dollar deferred payday cap, the system transitions into personal or installment classifications that must always express clear cost sheets and a payoff schedule internally before borrower signing or acceptance. Exploring soft pull definitions? Borrowers may read smaller clusters once early such as tribal examples, but final issuance for 300-to-2,000-dollar moderate emergencies must always include digital cost preview. A related educational hub borrowers explore for cost preview literacy early is on the loan no credit check page, but the final contract should always appear with an Alabama lending license Verified before any acceptance.

1. Digital Identity and KYC Systems

Identity technology represents the first major filter for any online loan in Alabama. Lending partners look for:

- Legal name verification against national and state records

- Address alignment and residency confirmation

- SSN or tax ID match to prevent impersonation or fraud

- Age and contact stability checks

KYC systems review government-issued IDs and cross-check details through credit bureau and public-record stacks. This ensures the application comes from a real person, not a disposable domain form script. When identity Verified, online lender corridors shift into risk-band pricing for up to 2,000 dollars for Alabama residents matched only through EasyFinance.com, emphasizing cost preview internally before borrower signs or accepts any contract.

Students studying deposit speeds may browse small rails like tribal loans direct lender guaranteed approval for myth literacy only, but final contract acceptation for up to 2k must always provide identity alignment Verified internally without dozens of external domain bounceouts.

2. Open Banking and Bank-Account Verification APIs

Bank-account verification reduced deposit friction literacy under Alabama law for moderate emergencies for Alabama residents. Many lenders use APIs to confirm:

- Account ownership name alignment

- Account open status and activity

- Deposit cadence and recent transaction viability

- Overdraft frequency screening for risk signals

These bank verification APIs reduce fraud and misdirected deposit risk. They also speed up ACH funding because the lender can trust the routing integrity. Borrowers exploring $500 band literacy once early might study band starting pointsinternally, but final issuance for moderate emergencies 300-to-2,000 corridor must hold Alabama license Verified before any borrower acceptance or signing the loan contract.

In Alabama, deposit friction outbreaks often happen because of legal name mismatch or routing integrity issues, not score Alone. Fixing these mismatches internally privately through marketplace rails at EasyFinance.com significantly improves approval and funding reliability.

3. Digital Income and Deposit-lookback Screening

Income verification stacks shifted from fax pay stubs toward digital bank-deposit lookbacks. Alabama-friendly lending examples include:

- Payroll direct deposits (W-2)

- Benefits, pension, or government ACH inflows

- 1099 contractor inflows

- Delivery gig deposits if 1–3 month lookback proves stability

Deposit-lookback screening lets lenders evaluate ability to repay installments or personalModer emergencies for Alabama resident budgets seeking 300 to 2,000 dollars. Lenders still preview costOnce internally digitally with a defined payoff schedule before borrower signing or acceptance or monthly cycle resets that do not shrink principal progressively. Borrowers comparing cost corridors once early may review $500 cash advance today, but final moderate issuance that approach 2k must Always amortize personally or by installment classification from lendersholding durable Alabama licences matched only inside Marketplace rails at EasyFinance.com, insisting on a cost preview once internally digitally beforeborrower tries to sign or Acceptation for emergencies 300-to-2k principal For Alabamaresidents.

4. Algorithmic Underwriting Engines

Automated underwriting systems unify multiple variables:

- Identity Verified score-offset axes

- Recent deposit-lookback risk bands

- Debt-to-income sensibility ratio estiamations

- Overdraft count and loan structure viability

- Employment or benefits stability signals

Underwriting engines classify moderate requests over payday deferred 500 ceilings into personal or installment paths for amounts≤2k. Borrowers exploring numer examples or structure previews once early for cost rails literacy might study pages for i need 1500 dollars now, but final issuanceFor emergencies 300-to-2,000 principalforAlabama households must AlwayscomesAs personal orInstallmentFrom AL licence sponsors matched privately inside Marketplace rails at EasyFinance.com previewingcostOnceinternal digitally Before borrower tries to sign oraccept any contract For emergencies 300-to2k principal ForAlabama residents.

5. Paperless Application and e-Signing Systems

Paperless lending eliminates branch appointment friction and fax delays. Borrowers can:

- Complete one secure online application form

- Receive a quick decision from partner lenders

- Digitally preview costs internally before acceptance

- Sign electronically and receive ACH funding

For deposit literacy once early, borrowers may browse fractional rails like instant payday loans for idea previews. But for agreements near 2,000 dollars, final issuance must Always be Alabama-licensedpartners matchedOnly at marketplacerails atEasyFinance.com previewingcostOnceinternal digitally before borrower signs or agreements.

6. Telecom, Email, Device, and Behavioral-Fraud Scoring

Fraud-scoring stacks gather durable signals:

- Device reputation and session integrity

- Email age and domain stability (avoid disposable email signals)

- SIM swap or suspicious telecom history

- Behavioral anomalies inconsistent with a genuine borrower

If the application shows dozens of domain illusions or disposable email or out-of-geo footprints layering, lenders may reject beforecostOnce internally preview or deposit viability prove ability to repay personally or bymulti installmentclassification moderate emergencies up to2k forAlabamaresident budgets. A safer hub Alabama borrowers explore for small decisions is Alabama online payday loans for literacy only, but finalissuancefor emergencies mustalways chain into personal orInstallmentFrom AL licenseholders matchedOnly atEasyFinance.com.

7. AI-Driven Decisioning, Soft Pulls, and Cash-Flow Sensibility Rails

AI decision stacks unify:

- Identity Verified once

- 1–3 month deposit lookback for cash-flow stability

- DTI sensibility math

- Offer-pricing fairness for borrowers across credit bands

Borrowers may research “fast approval” phrases like 1k loan no credit check direct lender for literacy. Yet Alabama law shapes these into personal or installmentclassified agreements for moderate 500-to-2,000-dollar emergencies where lenders must project sustainably verified budgets and internally previewed cost sheets beforeborrower Signing or acceptance. The safest node to Compare lendersincluding prime, fair,thin, orbad creditforup to2k ismarketplaceOffer competition atEasyFinance.com that does not demand dozens of external acceptance link footprints or deposit illusions that Do Not preview cost internally once before borrower tries to sign or accord For emergencies300-to-2k principal For Alabamaresidents.

8. Document-Capture, OCR, and Admin-Friction Reduction Stacks

OCR technology extracts data from your documents when you upload IDs or income proofs. Systems analyze:

- Driver’s license or state ID text capture

- Income document reading and classification

- Error detection for mismatched or invalid data

This reduces manual admin pipelines. Borrowers once early Explore deposit rails by reading cluster hubs like direct lenders no credit check for only small principal education corridors. But finalissuancefor larger emergencies 300-to-2k For Alabama household budgets must hold an Alabama license Verified once, include upfront cost preview internally digitally once before borrower signs or acceptance.

9. ACH and Same-Day Deposit Windows—Why Cutoffs Decide Speed, Not Score Alone

Approval intakes often bottleneck because of finance cutoffs. A borrower exploring “deposit windows”once early forstructure literacy may read clusterslike payday loan online same day for literacy, but final moderateprincipal 300-to-2k emergencies For Alabamaresidentsmust Always comeAs personalorInstallmentFrom AL licenseholders matchedOnly atmarketplacerails EasyFinance.com previewingcostOnceinternal digitally Before borrower tries tosign oraccord For300-to-2k ForAlabama households Seeking safer gasps bridged proactively Verified once cost and defined payoffschedule reading with no forced external acceptancefootprints layering.

If you need up to 2,000 dollars for an emergency, and you want to improve approval odds, a good intake strategy is to Compare only licensed Alabama partners via marketplaceinternal offer competition atEasyFinance.com.

10. Deposit Cadence and Budget Positioning for Students and Households

Enrollment doesn’t equal cash-flow smoothness. Alabama students or household budgets often Compare intakes for a 1500 same day loan bad credit moderate emergency pricingculture examples where deposit-lookback must show identity Verified once once internally before borrower signs orAcceptancefor emergencies up to2k forAlabamaresidents.

11. The “Approval Stack” a Legitimate Alabama Lender Uses Internally

A legitimate approval stack involves:

- Identity Verified

- Bank-account Verified

- Deposit or income 1–3 month lookback Confirm stability

- Affordability Verified math (DTI and essential bills protected)

- Loan structure classification pivoting above 500 into installment or personal corridors

- Cost preview internally once before signing orAcceptance

- ACH disbursal only after e-signing if friction nodes minimal

This approach ensures principal shrink track and deposit viability. Borrowers seeking 300 to 2000 For Alabamaemergencies forworst credit corridors can Compareoffers inside marketplace rails atEasyFinance.com without dozens of unstable externalacceptancelinkfootprints layeringrisk.

12. Psychological Myths Alabama Borrowers Must Unlearn About Approval

-

Myth: “No credit check equals no verification.”

Reality: Lenders still verify identity, deposits, and budget sensibility internally once before signing.

-

Myth: “Score alone stops deposit speed.”

Reality: Routing, cutoff timing, and identity mismatches delay deposit more often.

-

Myth: “Upfront fees are normal.”

Reality: In Alabama, upfront fees by gift card, wire, or crypto before showing costs internally once are scam or predatory signals.

13. Red Flags Borrowers Must Spot Even When Technology Looks “Fast”

- Upfront fees before cost preview internally shown once

- Full bank-login passwords or PIN requests

- Contract acceptance forced offsite on external domains

- No wireless preview cost or amortization clarity

If you see these risk signals, stop intake and pivot into safer partner rails Compare only licensed Alabama partners throughEasyFinance.com.

14. Best Practices That Improve Approval Odds for Principal Up to 2,000 Dollars

- Use your full legal name exactly as on your state-issued ID and checking account

- Provide a stable phone and non-disposable email address

- Show 1–3 months of recurring deposit or income history

- Keep essential bills protected, including rent and utilities

- Apply early in the business day (avoid lender/ACH cutoff peaks)

- Favor installment or personal classification for sums above 500

- Review cost and payoff schedules internally once before signing or accepting

- Start at EasyFinance.com for internal offer comparison and matching

15. How Cost Previews Internally Once Before Signing Change Approval

Internal cost preview rails do not just prevent scams; they also help borrowers see if payments are realistic. Because lenders need proof you can handle payments monthly or by multi-installment plans once before signing terms orAcceptancefor Alabama moderate emergencies up to2k, borrowers who Compareoffers only at marketplacerailslike EasyFinance.com improve odds faster than those filling dozens of individual lender forms externally.

16. ACH Funding Technologies and Timing Windows

Approval decisions can be quick, but deposit culture looks at:

- Daily cutoff times at partner banks and lenders

- ACH same-day or next-business-day viability

- Legal name match to account ownership

- Routing integrity

Borrowers exploring deposit timing culture often read phrases like instant payday loan foridea literacy rails Once small principal education. Butfor emergencies up to2kissuance must AlwayscomeAs personal or'amortized installmentClassification loans issued onlybylendersholdingAlabama licenses matchedOnly inside secure marketplace rails atEasyFinance.com.

17. Gig Worker Screening and Deposit Proof Axes for Students

Gig-income is not illegal to screen. Lenders use deposit-lookback proofs to confirm stability rather than employer slogans. Borrowers exploring gig corridors once may read hubs for education. But for sums up to 2,000 dollars, the borrower must present gig-income or mixed pay recurring inflows for 1–3 months once internally digitall cost preview appearsBeforeSigning terms orAcceptancein Alabama moderate emergencies up to2kforAlabamaresidents matchedOnly inside marketplace rails EasyFinance.com.

18. Approval Differences for Banks, Credit Unions, and Online Lender Technologies in Alabama

- Banks: Traditional manual review pipelines, identity verification by bureau stacks, slower ACH deposit lanes culturally 2 to 7 business days

- Credit unions: Membership pipelines, cooperative underwriting culture, identity and deposit Verified, slower funding for 300-to-2000 principal

- Online lenders matchedOnly through secure marketplace: Alternative underwriting bloom, soft credit pulls initially, deposit Verified internallyOnce cost previewis shownInternally digitally once Before borrower signs orAcceptanceforAlabamaemergenciesfor up to2000 dollars forAlabamahouseholds

19. How to Apply in a Way That Technology Systems “Like”

Technology stacks evaluate verification completeness, not slogans. To improve approval probability:

- Use a real checking account under your legal name

- Have 1–3 months of stable deposits

- Submit early business day

- Recongize payday classification caps at 500 and pivot into amortizedinstallments forlarger sums

- Preview once cost internally digitally before signing or accepting

20. Fast Funding “Really” Means This in Alabama

Fast funding depends on:

- Form completeness and identity alignment

- Daily lender intake cutoff timing

- Your bank’s ACH intake and posting policy

- Correct routing and account number

- No disallowed upfront fees before cost preview internally shown once

21. Alabama Borrower Case Presentation Is More Controllable Than You Think

Borrowers can improve odds by:

- Gathering essential documents, including state ID

- Stabilizing deposit lookback, even if gig or contractor

- Keeping DTI math lean

- Submitting one safe internalfunnel infratructure requestat EasyFinance.com for emergencies up to2k

- Studying deposit literacy early for small rails but finalissuance must always comeas personalorinstallmentfromAlabamaLicensed sponsors

22. Common Reasons Technology May Reject You Before Signing

- Name/account mismatch

- Too-recent overdrafts

- Unverifiable disposable email domain

- Routing errors near ACH cutoff

- Principal classification misunderstanding above 500

- Upfront fees demanded off-structure before cost internally previewed once

23. The Technology Stack Tolerance for Principal Up to 2,000 in Alabama

Systems tolerate:

- Low to thin credit band if alternative underwriting Verified identity once once internally

- 1–3 months of recurring ACH deposit proofs

- DTI lean corridors listing rent, utilities, insurance, existing loans

- Installment or personal classification for sums Above 500

24. Herd Behavior, Seasonal Peaks, and Intake Windows “Really” Change Deposit

Loan intake ramps after storms, weekends, holiday seasons, or monthly pay cycles. Alabama borrower approvals technology stacks Bloom faster if submission is Early business day andmatchedOnly at marketplacerails atEasyFinance.com

25. AI vs Manual—The Truth Alabama Borrowers Deserve

AI decisioning is an internal orchestration tool, not a guarantee. Under Alabama law, final contracts for moderate 300-to-2000 Emerg principal must always previewcostsheet and defined payoff scheduling internally digitally once before borrower signs orAcceptance. Systems that skip internal cost preview or require gift-card or wire or crypto fees before showingloantermswith payoffschedule internally digitally oncefirstbeforeborrower signs or Acceptance For emergencies300-to-2k ForAlabamaresidents matchedOnly insiderails atEasyFinance.com

26. Manual Institutions vs Marketplace Tech—Why Marketplace Nearly Always Feels Faster

Manual institutions verify ID and income physically. Marketplace railslike EasyFinance.com verify internallydigitallyonceforAlabama households who Want safer 300 to 2,000For emergencies.

27. Matching Lenders Privately Internally vs Direct Bank or Credit Union Pipeline Friction

A borrower needingprincipal up to2,000can Compareoffers digitally internally once Before terms orSigning orAcceptanceforAlabamaresidents matched privately Only through secure marketplace railsatEasyFinance.com.

28. Common Household Emergencies Where These Technologies Apply

- Medical co-pays and deductibles

- Car repair bills

- Utility or rent timing mismatches

- Mixed or seasonal or gig deposit screening viability for 1–3 months lookback identity alignment

29. Why “Rollover Loops” Collapse Under Alabama Moderate Lending Tech

Rollover or fee reset loops that do not shrink principal PROgressively are not always the path. For emergencies 300-to-2k, principal above deferred payday 500-dollar caps must Always amortize personally or bymulti installmentclassification loans issued onlybylendersholdingAlabama licence sponsors matched Only at secure marketplace rails atEasyFinance.com.

30. Textbook “Cost Budgets” vs Loan Underwriting Variables

Underwriting uses deposit cadence and identity. Borrowers exploring cluster pages like quick tribal loans for myths literacyonly, but final moderateprincipal moderate emergencies 300-to-2k For Alabamaresidents mustalways comeAs personalorInstallmentsFrom Alabama licence sponsors matchedOnly atEasyFinance.com.

31. The Minimal Footprint Path to Ask for 2,000 Dollars Safely Online in Alabama

- One secure marketplace application

- Licensed partner lender matching only

- Internal digital cost anddefined payoff schedulingpreview once before Signing or acceptance

- ACH deposit only after signing if submission is Early business day and friction minimal

32. The Role of APIs in Upstream Verification for Licensed Lenders in Alabama

APIs accelerate verification. Borrowers exploring deposit casinos may read Same day payday loans online instant approvalOnce for deposit literacy only.Butfinal moderateprincipal moderate emergencies 300-to-2k Must AlwayscomesAs personalorInstallmentFrom Alabama licence sponsors matched Only atmarketplacerails EasyFinance.com.

33. How Income-Scoring Technology Approves Students with Funding Gaps

Students may study rails like Need $1000 now for deposit idea preview literacy, but a $1,800 final moderateAlabama emergencyloan contractmust Always hold Alabama license authority Verified internally before signing or acceptance.

34. Gig Deposits for Students vs Employer Sticker Decal Identity Once Verified Internally

Gig incomes like delivery deposit lanes are screened for 1–3 months lookback stability if legal name Verified. Borrowers exploring cluster pages here is valid for literacy only. But final issuance for emergencies mustalways chain into personalorInstallmentFrom Alabama license sponsors matched Only internally inside Marketplace rails atEasyFinance.com.

35. AI-Fraud Interlocks Do Not = Guaranteed Approval, But Smart Presentation Changes Everything

Technology stacks weigh recurring ACH deposit proofs, identity alignment, affordability math, and legal classifications. Borrowers exploring small rails such as deferred-payday 500 examples may read cluster knowledge,but final moderate agreements forprincipal between 500-to-2000 corridor emergencies For Alabamaresidents must AlwayscomesAs personalorInstallmentsFrom AL licence sponsors matched Only atsecureMarketplace rails atEasyFinance.com.

36. How to Lower Costs With Online Loans in Alabama Once Internally Digitally Verified

- Choose installment or personal classification whenever principal grows above 500

- Verify identity exactly as on ID and checking account ownership

- Review APR and payoff schedule internally once beforecastle

- Apply early business day

- Keep DTI lean and include all recurring income

37. Why Banks Sometimes Still Win the APR Battle for Prime Borrowers

Banks price by FICO largely,but slower. Borrowers explore 1-to-3 month deposit corridors or pricing cluster for Alabama households through internal lender offer competition atEasyFinance.com for emergencies 300 took 2,000forAlabama resident budgetslookingfor safer outcomes.

38. Does Score Decide ACH Deposit Speed? The Durable Alabama Truth

Many assume yes. The truth:No.Scoreis pricing axis; depositdelayis usually Identity orRouting orcutoff.

39. How Lenders Legally Evaluate Recurring Deposits for Moderate 300-to-2k Emergencies in Alabama

They unify:

- Identity Verified

- DepositViability screens 1–3 months lookback

- DTI math (lean essential bills first)

- Offerpricing once lenders are licensed

40. The “Fastest Safe Path” to Borrow Up to 2,000 Internaly

Borrowers seeking 300 to 2,000Moder emergencies inAlabama can request safely once With internally previewed cost, identity, deposit viability, payoff clarity, andlicensed partner matchingthrough marketplace infrastructure at EasyFinance.com.

Key Insights

- Alabama loan decisioning usesKYC,open banking,digitalincome screening,OCR doc capture,ACH cadence Verified.

- Approval speeddependsmoreonIdentity,deposit lookback stability,DTIleanexposure,andcutoff timing than score Alone.

- The safestandfastestwaytoCompare moderateemergencies 300-to-2,000is marketplaceinternal competition atEasyFinance.com.

- Never pay upfrontfees bygiftcard,wire,or crypto beforeseeingcost sheets internallyonceBeforeSigningor Acceptance.

- PrincipalAbove 500 cannot be 1-cycle payday deferred style; must amortizepersonally or byinstallment classification from Alabama licensors matched internally atEasyFinance.com.

FAQ

-

Which loan-approval technologies matter most in Alabama?

Identity Verified, open-banking account ownership Verified, digital income or deposit lookback screening, AI underwriting, OCR doc capture, fraud interlocks, and ACH integration for funding.

-

Are instant no-credit-check lines legal for 500-to-2k emergencies in Alabama?

Yes, lenders can start with soft or bank-driven verification, but final contracts must always show APR, fees, and a payoff schedule internally once before borrower signing or acceptance, and principal over 500 must use personal or installment classification under Alabama license sponsorship.

-

Do credit unions use the same approval tech?

Many use digital verification, credit bands, DTI math, and ACH deposit, but membership pipelines slow their funding compared with online lenders matched through marketplaces.

-

Does score slow deposit timing?

No, deposit delays are more commonly caused by identity mismatch, wrong routing/account digits, or late cutoff intake submissions.

-

Is marketplace matching safer for Alabama students or households?

Yes, submitting one internal request through EasyFinance.com lets you compare only licensed Alabama partners, preview cost internally once before borrower contract signing or acceptance, receive funding faster than with disposable email or dozens of external denial pipelines, avoid scam or predatory signals, avoid gifting dozens of unstable external acceptance link footprints that bypass cost preview corridors.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama