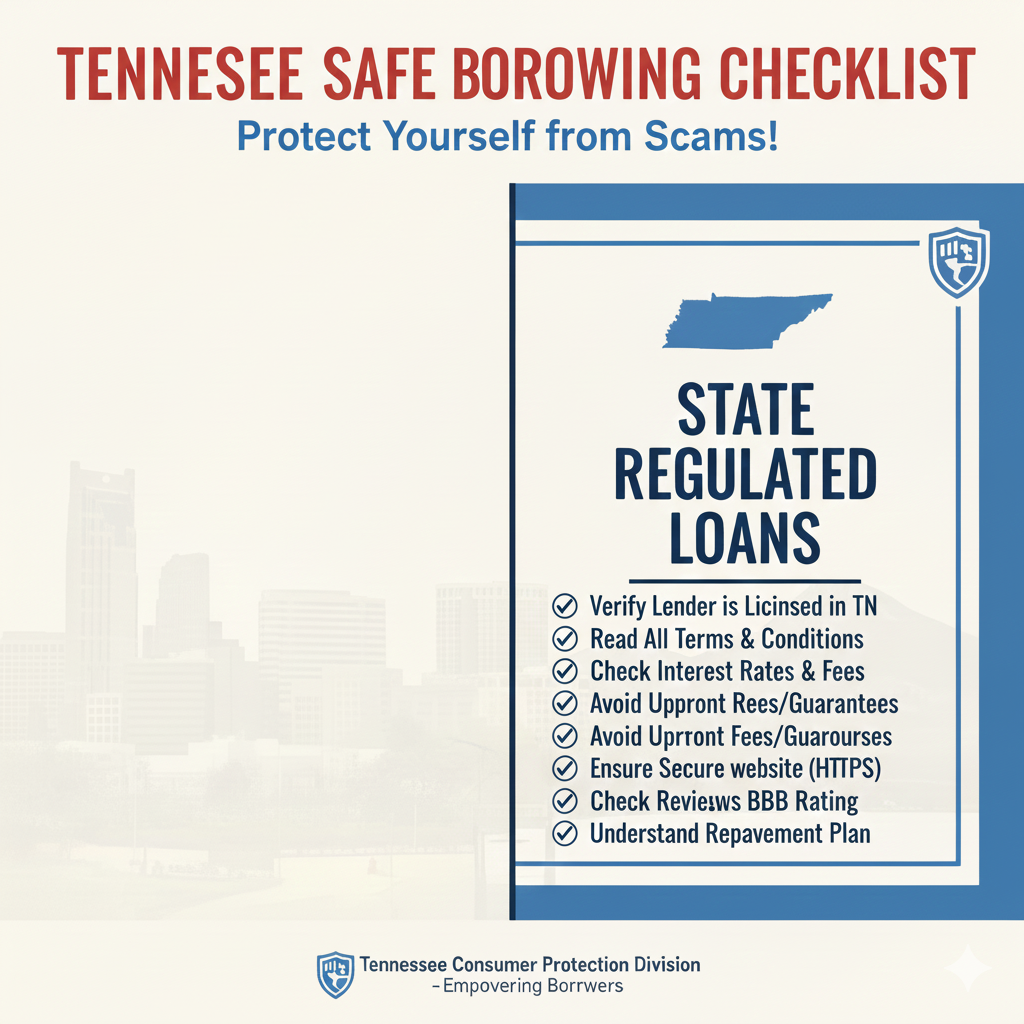

Tennessee Safe Borrowing Checklist for Online Loans

Tennessee residents deserve a clear, secure path to borrow online without falling into scam funnels or predatory fee loops. Before submitting your personal or banking details, run through this fast, practical checklist. EasyFinance.com supports borrowers who want up to 2000 dollars safely by matching them only with vetted, transparent lenders through encrypted applications and fair, traceable deposit rails.

Safety First: Verify the Site Before You Apply in 2026

- Type the domain manually into your browser instead of clicking links from text messages, comments, or unsolicited emails.

- Confirm the service role is stated clearly (direct lender, marketplace, or lender-matching platform).

- Make sure the website has been live long enough to establish a real digital and borrower support footprint.

- Look for a privacy policy explaining data usage, storage, and encryption.

- Check for spelling errors in the brand name or web address that could signal a cloned lending site.

No-Fee Rule: Legit Lenders Never Charge Before Funding

- No processing fees before funds are deposited.

- No insurance, tax, or "refundable deposits" collected upfront by gift card, crypto, or person-to-person transfer.

- Never pay money to receive money. It is illegal under U.S. consumer lending standards and always a scam or predatory signal in Tennessee.

- Fee discussions must appear in repayment breakdowns, not before disbursement.

- Watch out for email or SMS stating “approved” prior to a real application. If it appears before you apply, it is not a lender.

Realistic Approval Hygiene and Required Checks

- Identity verification is mandatory. Legit lenders verify legal identity through secure portals, not chats.

- Income or deposit source verification is mandatory. Even no-score credit products verify affordability safely.

- Bank account ownership must be confirmed. Funds may only land into an account that belongs to you.

- Deposit rails should be traceable. ACH direct deposit is the modern standard for Tennessee residents.

- If the loan is installment-based, check that payments reduce principal, not just interest.

- Reasonable eligibility is fine, “guaranteed approval for everyone” is illegal and predatory.

Communication and Support Accountability

- A real customer care phone number. Lack of phone support is a lending-scam or anonymity risk signal for Tennessee residents.

- A real business address (city, state/province, country if provided).

- Human accountability details (support hours, disclosure pages, service role clarity).

- Collection behavior must be explained beforehand. Legit lenders discuss late fees and dispute policies in plain language.

- Pressure or threats are never part of legitimate compliance. Real lenders profit from repayments, not panic narratives.

Cost Realism and Responsible Borrowing Essentials

- Estimated APR and total payoff must be understandable.

- Borrow only what is truly needed to avoid unnecessary cost stacking.

- Calculate whether payments fit your next pay cycle realistically before accepting terms.

- Installment options must clearly show payment timing and principal reduction.

- Tribal or sovereign lending matches must still disclose costs clearly and never require advance payments.

- Matching ecosystems like EasyFinance.com verify lenders before showing offers. That single internal safety layer determines more borrower protection than random domains ever will.

Emergency Borrowing Behavior (Safe vs Unhealthy)

Unhealthy Funnel Behaviors

- Clicks unknown domains first

- Pays verification fee first

- Shares bank login password

- Rolls over repeatedly with new fees

Safe Funnel Behaviors

- Verifies lender identity first

- Reviews total cost before agreeing

- Submits data into a secure system only

- Sees repayments clearly reduce principal

- Fees deducted only after deposit

- Deposit rails tied to U.S. checking accounts owned by you

If any question or page element makes you feel rushed or asks you to pay or verify with untraceable formats, close the site and switch immediately to a BBB accredited lender-verified ecosystem.

Key Insights

- Verification is always required legally for every real lender issuing loans in Tennessee.

- Upfront fees are illegal when collected before funding exists in Tennessee and across the United States.

- Deposit rails must always be traceable and land into a U.S. checking account that belongs to the borrower.

- Fraud thrives on panic, real lending thrives on repayments.

FAQ

- Is it legal to borrow online in Tennessee? Yes, when the lender or matching platform identifies itself transparently and fees are deducted only after funds are deposited.

- What is the biggest scam indicator? Any request to send money before receiving money, or any suggestion that approvals are automatic for everyone.

- How fast can deposits happen safely? Often same-day if verified early and processed through banking rails like ACH, but never “instant by default” for everyone.

- Are installment loans safer? They can be if repayment reduces principal clearly and costs are disclosed before acceptance—not hidden later.

- Is lender matching safer than clicking random sites? Yes, if the matching ecosystem verifies lenders before showing offers, such as EasyFinance.com.

- Does EasyFinance charge fees before deposits? Never. The platform blocks upfront fee abuse and verifies lenders before matches exist.

Explore More Tennessee Loan Resources

- Online Loans in Tennessee: Complete Guide for Borrowers

- Tennessee Online Loan Market Trends and Insights

- How Online Personal Loans Work in Tennessee

- Tennessee Licensed Lender Verification Guide

- Licensed Online Loan Providers in Tennessee

- Tennessee Online Loan APR and Interest Rate Limits

- Tennessee Online Loan Fees and Charge Caps

- Online Loan Rates for Tennessee Borrowers

- Online Loan Comparison in Tennessee

- Best Online Loan Comparison Platforms for Tennessee Residents

- Same-Day Deposit Loans Online in Tennessee

- Fast Approval Online Loans in Tennessee

- Instant Decision Online Loans in Tennessee

- Quick Personal Loans Online in Tennessee

- Installment Loans Online in Tennessee Explained

- Typical Installment Loan Terms for Tennessee Borrowers

- Unsecured Personal Loans Online in Tennessee

- Direct Online Loan Lenders for Tennessee Residents

- Online Loan Marketplaces vs Direct Lenders in Tennessee

- Online Payday Loans in Tennessee Explained

- Are Online Payday Loans Legal in Tennessee?

- Tennessee Short-Term Loan Waiting and Re-Borrowing Rules

- How Fast Online Loan Deposits Work in Tennessee

- Loan Extensions and Rollovers Under Tennessee Rules

- Can You Extend a Short-Term Online Loan in Tennessee?

- Paycheck Advance Loans Online for Tennessee Residents

- Payday Loans vs Paycheck Advances in Tennessee

- Short-Term Cash Loans Online in Tennessee

- Fast Funding Online Loans for Tennessee Residents

- How Quickly Online Lenders Fund Loans in Tennessee

- Loans for All Credit Scores in Tennessee

- Online Loans for Bad Credit in Tennessee

- Tennessee Bad Credit Loan Requirements

- Top Rated Bad Credit Loan Lenders in Tennessee

- How Credit Scores Affect Online Loan Approval in Tennessee

- 500 Credit Score Online Loan Options in Tennessee

- No Credit Check Loans in Tennessee: What’s Allowed

- Are No Credit Check Loans Legal in Tennessee?

- Soft Credit vs Hard Credit Check Loans in Tennessee

- No Income Verification Loans Online in Tennessee

- Tennessee Online Loan Application Document Checklist

- Tennessee ID & Residency Requirements for Online Loans

- Accepted Income Sources for Online Loans in Tennessee

- Gig Worker Loans Online in Tennessee

- Using DoorDash Income for Online Loan Approval

- Lowest Interest Rate Online Loans in Tennessee

- Low APR Personal Loans for Qualified Tennessee Borrowers

- Small Cash Loans Online for Tennessee Borrowers (300 to 2000)

- Emergency Loans Online for Tennessee Residents

- Online Loans for Medical Bills in Tennessee

- Emergency Cash Loans for Health Expenses in Tennessee

- Car Repair Loans Online for Tennessee Residents

- Loans for Unexpected Expenses in Tennessee

- Moving Cost Loans Online for Tennessee Residents

- Rent Payment Loans Online for Tennessee Borrowers

- Utilities Assistance Loans Online in Tennessee

- Holiday Loans Online for Tennessee Residents

- Tennessee Online Loan Demand During Emergencies

- Tornado Relief Loans Online for Tennessee Residents

- Severe Storm Relief Loans Online in Tennessee

- Top Loan Scams Targeting Tennessee Residents

- How to Spot Fake Loan Sites in Tennessee

- Predatory Online Loan Warning Signs in Tennessee

- How to Verify If an Online Lender Is Legit in Tennessee

- Tribal Loans vs State-Regulated Loans for Tennessee Borrowers

- Are Tribal Loans Safe for Tennessee Residents?

- Tennessee Safe Borrowing Checklist for Online Loans

- Avoiding Online Loan Debt Traps in Tennessee

- How to Break the Borrowing Cycle With Online Loans

- Practical Ways to Reduce Online Loan Costs in Tennessee

- Tennessee vs Florida Online Loan Law Differences

- Kentucky vs Tennessee Online Loan Rules

- Mississippi vs Tennessee Online Loan Regulations

- Tennessee Online Loans vs Bank Loan Costs

- Tennessee Online Loans vs Credit Union Loan Costs

- How to Improve Online Loan Approval Odds in Tennessee

- How Online Loan Approval Systems Work in Tennessee