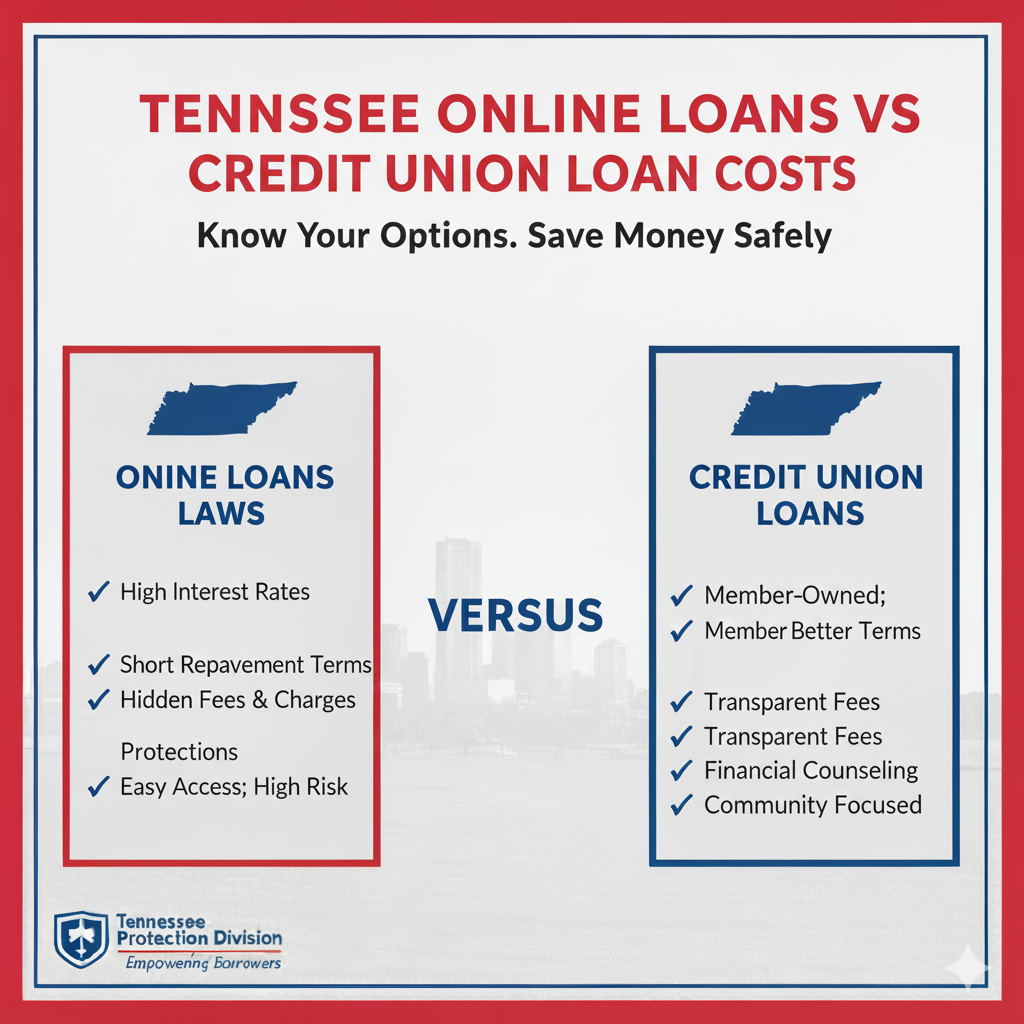

Tennessee Online Loans vs Credit Union Loan Costs

When Tennessee residents need extra cash—whether for a car repair, unexpected medical bill, or bridging a temporary paycheck gap—they often consider either quick online loans or borrowing from a local credit union. Each option has trade-offs. Online loans offer speed and flexibility but often at a higher cost, while credit union loans tend to be cheaper but slower and more restrictive. Understanding those differences helps you choose what’s right for your situation.

If you are exploring online options, start with a secure, trusted matching service such as EasyFinance.com. That way you avoid risky fee-first scams, and only review offers from lenders who comply with identity, income, and banking-rail standards.

Cost Comparison in 2026: Online Loans vs Credit Union Loans

Interest Rates and APR

Credit unions typically offer personal or installment loans at moderate APRs—often ranging from the low double digits to low twenties (for borrowers with fair credit). Their rates are lower because they operate under cooperative and member-oriented governance rather than high-risk short-term lending models. If you borrow $5,000 or $1,000, the interest cost over several months or years tends to remain reasonable.

Online small-dollar loans aimed at immediacy often come with much higher APRs because lenders price in risk and speed. For example, a borrower requesting to i need $500 today may face significantly higher interest and fees. However, the total cost depends heavily on how quickly the loan is repaid. If repaid promptly, a high APR may translate to a manageable cost rather than a long-term debt burden.

Fees and Upfront Costs

Credit unions rarely charge outrageous fees for loan origination, especially for members. You might see a small processing or application fee, but these are much smaller than the fees or high-interest structures often embedded in online loan offers.

Online lenders often compensate high APRs with convenience, and fees can be hidden in processing, administration, or rollover charges—especially if the loan is extended or refinanced. A borrower searching for same day loans should carefully confirm the complete fee and repayment schedule before accepting the loan to avoid surprise cost inflation.

Loan Qualification Requirements

Credit unions typically require decent credit or at least a predictable income history, membership in the credit union (which may require residency or other criteria), and possibly collateral or savings-account linkage for higher-dollar loans. Approval takes longer, often several days, and funding may require in-person or verified online banking steps.

Online loans — particularly those advertised to bad-credit borrowers or through short-term lending websites — claim ease of access with minimal paperwork. Borrowers requesting to get 1000 dollars now or to borrow 1500 dollars might get approval quickly. But this speed often comes at the cost of higher interest rates and stricter repayment demands, which increases risk of rollover pressure if bills arrive before repayment is possible.

Funding Speed and Convenience

This is the area where online loans shine. Credit union loans often take 1–7 business days to process, depending on application submission, document verification, and internal underwriting. For urgent needs, that lag might be too long.

Online lenders (when legitimate) may fund via ACH or bank deposit rails quickly if identity verification is completed early in the business day. Borrowers who accept same-day-available options like need $2000 loan urgently bad credit no credit check enjoy faster cash—but must carefully follow repayment schedules to avoid high interest or fees.

Which Borrower Types Benefit More from Each Option

- If you have fair to good credit, predictable income, and can wait a few days: A credit union loan is likely the most cost-efficient choice long-term. Lower interest rates, predictable fees, and more borrower-friendly terms make it ideal for paying off larger expenses or consolidating smaller debts.

- If you need money fast and can repay quickly: A well-vetted online loan may make sense. Borrowing a small amount for a short time can work — provided fees are disclosed upfront, repayments reduce principal, and you avoid rollover traps.

- If credit history is weak or you need a small, fast loan: Matching platforms that offer options for bad-credit borrowers may attract you. Use only a trusted portal to reduce your risk, and treat repayment as a top priority to avoid interest-overwhelm.

Risks for Tennessee Borrowers Using Online Loans

- Cost inflation through renewals or refinancing: Many online lenders encourage extensions rather than payoff, which increases total interest paid over time.

- Fee stacking and hidden charges: Some sites disguise processing or “verification” fees. Always check the full cost before signing, and avoid sites demanding payment before deposit rails are validated.

- Short repayment windows: Rapid repayment deadlines can clash with variable income cycles, causing missed payments or forced renewals.

- High APR relative to loan size: Small loans with high APRs can cost more in fees than the amount borrowed if you carry the balance too long.

When a Credit Union Loan Might Be Riskier than an Online Loan

- Slow funding: If you need cash immediately, waiting days for loan approval and deposit may not be an option.

- Strict underwriting requirements: Credit unions often check history, require membership, documentation, or co-signer for higher amounts — which can be a barrier, especially for borrowers with poor credit or irregular income.

- Lower flexibility for smaller emergency loans: Many credit unions focus on larger personal or auto loans rather than sub-$1,000 short-term funding, so they may not meet small emergency needs effectively.

Smart Borrowing Strategy: Blending Options Responsibly

You don’t always have to choose strictly between “online loan” or “credit union loan.” Consider this blended approach:

- Use a credit union loan for larger expenses or longer payoff plans — you get lower interest, predictable repayment, and lower overall cost.

- Use a short-term online loan only if you absolutely need speed — borrow the minimum necessary, and repay at first income deposit to minimize interest burden.

- Avoid rollover schemes or extension traps that reset interest or add fees — treat repayments as a priority, not afterthought.

- Use a trusted loan-matching portal like EasyFinance.com to compare online lenders safely if you go the digital route, so you avoid upfront fee scams or rogue lenders.

Key Insights

- Credit union loans usually cost less over time, thanks to lower interest rates and stable terms.

- Online loans provide convenience and speed, but often at a higher cost — especially if not repaid quickly.

- The cheapest loan isn’t determined by APR alone — it’s determined by how fast you pay it off and whether your payments reduce principal.

- Never pay any fee before receiving funds — that is the clearest sign of a scam or abusive loan funnel.

- For Tennessee borrowers needing up to 2,000 dollars quickly, a secure, BBB-accredited matching platform like EasyFinance.com offers a safer comparison path than random online loan ads.

FAQ

- Are credit union loans cheaper than online loans? Generally yes — if you are approved and can wait a few days for funding. Their interest rates and overall cost are typically much lower.

- When should I consider an online loan instead of a credit union loan? When time is critical, the amount needed is small, and you can repay quickly to avoid high interest costs.

- Is it legal for an online lender to charge a fee before funding? No. Legitimate U.S. online lenders must deduct fees only after funds are deposited into an account you own.

- Can I trust short-term loans if I have bad credit? Yes — but only if you use a reputable, screened platform and make sure repayment terms are clear and realistic before you sign.

- What’s the safest way to borrow online in Tennessee? Use a verified platform like EasyFinance.com that screens lenders first, encrypts applications, and offers clear repayment and cost disclosure before paperwork is submitted.

Explore More Tennessee Loan Resources

- Online Loans in Tennessee: Complete Guide for Borrowers

- Tennessee Online Loan Market Trends and Insights

- How Online Personal Loans Work in Tennessee

- Tennessee Licensed Lender Verification Guide

- Licensed Online Loan Providers in Tennessee

- Tennessee Online Loan APR and Interest Rate Limits

- Tennessee Online Loan Fees and Charge Caps

- Online Loan Rates for Tennessee Borrowers

- Online Loan Comparison in Tennessee

- Best Online Loan Comparison Platforms for Tennessee Residents

- Same-Day Deposit Loans Online in Tennessee

- Fast Approval Online Loans in Tennessee

- Instant Decision Online Loans in Tennessee

- Quick Personal Loans Online in Tennessee

- Installment Loans Online in Tennessee Explained

- Typical Installment Loan Terms for Tennessee Borrowers

- Unsecured Personal Loans Online in Tennessee

- Direct Online Loan Lenders for Tennessee Residents

- Online Loan Marketplaces vs Direct Lenders in Tennessee

- Online Payday Loans in Tennessee Explained

- Are Online Payday Loans Legal in Tennessee?

- Tennessee Short-Term Loan Waiting and Re-Borrowing Rules

- How Fast Online Loan Deposits Work in Tennessee

- Loan Extensions and Rollovers Under Tennessee Rules

- Can You Extend a Short-Term Online Loan in Tennessee?

- Paycheck Advance Loans Online for Tennessee Residents

- Payday Loans vs Paycheck Advances in Tennessee

- Short-Term Cash Loans Online in Tennessee

- Fast Funding Online Loans for Tennessee Residents

- How Quickly Online Lenders Fund Loans in Tennessee

- Loans for All Credit Scores in Tennessee

- Online Loans for Bad Credit in Tennessee

- Tennessee Bad Credit Loan Requirements

- Top Rated Bad Credit Loan Lenders in Tennessee

- How Credit Scores Affect Online Loan Approval in Tennessee

- 500 Credit Score Online Loan Options in Tennessee

- No Credit Check Loans in Tennessee: What’s Allowed

- Are No Credit Check Loans Legal in Tennessee?

- Soft Credit vs Hard Credit Check Loans in Tennessee

- No Income Verification Loans Online in Tennessee

- Tennessee Online Loan Application Document Checklist

- Tennessee ID & Residency Requirements for Online Loans

- Accepted Income Sources for Online Loans in Tennessee

- Gig Worker Loans Online in Tennessee

- Using DoorDash Income for Online Loan Approval

- Lowest Interest Rate Online Loans in Tennessee

- Low APR Personal Loans for Qualified Tennessee Borrowers

- Small Cash Loans Online for Tennessee Borrowers (300 to 2000)

- Emergency Loans Online for Tennessee Residents

- Online Loans for Medical Bills in Tennessee

- Emergency Cash Loans for Health Expenses in Tennessee

- Car Repair Loans Online for Tennessee Residents

- Loans for Unexpected Expenses in Tennessee

- Moving Cost Loans Online for Tennessee Residents

- Rent Payment Loans Online for Tennessee Borrowers

- Utilities Assistance Loans Online in Tennessee

- Holiday Loans Online for Tennessee Residents

- Tennessee Online Loan Demand During Emergencies

- Tornado Relief Loans Online for Tennessee Residents

- Severe Storm Relief Loans Online in Tennessee

- Top Loan Scams Targeting Tennessee Residents

- How to Spot Fake Loan Sites in Tennessee

- Predatory Online Loan Warning Signs in Tennessee

- How to Verify If an Online Lender Is Legit in Tennessee

- Tribal Loans vs State-Regulated Loans for Tennessee Borrowers

- Are Tribal Loans Safe for Tennessee Residents?

- Tennessee Safe Borrowing Checklist for Online Loans

- Avoiding Online Loan Debt Traps in Tennessee

- How to Break the Borrowing Cycle With Online Loans

- Practical Ways to Reduce Online Loan Costs in Tennessee

- Tennessee vs Florida Online Loan Law Differences

- Kentucky vs Tennessee Online Loan Rules

- Mississippi vs Tennessee Online Loan Regulations

- Tennessee Online Loans vs Bank Loan Costs

- Tennessee Online Loans vs Credit Union Loan Costs

- How to Improve Online Loan Approval Odds in Tennessee

- How Online Loan Approval Systems Work in Tennessee