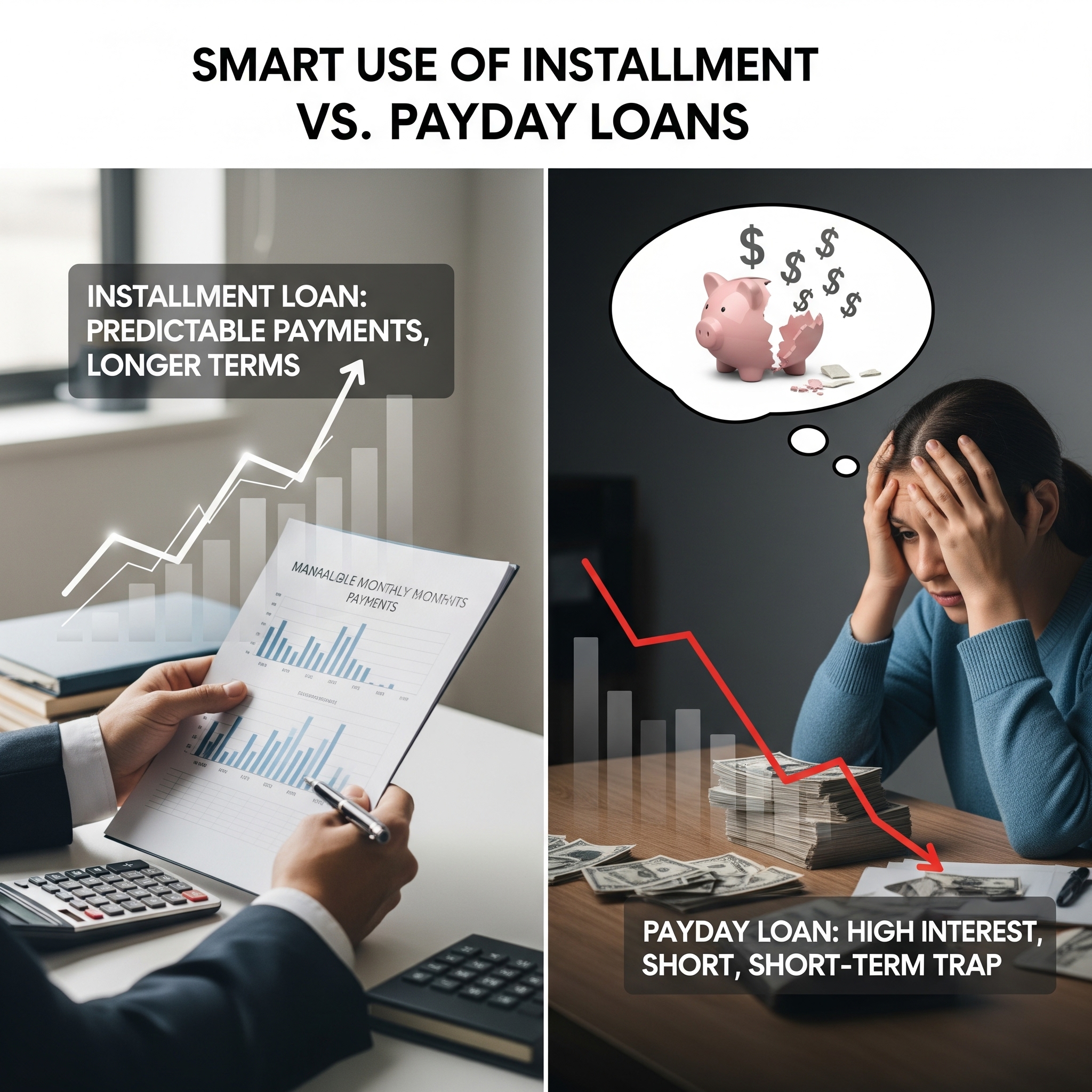

Smart Use of Installment vs. Payday Loans

When unexpected expenses strike, many borrowers turn to short-term financing options. Two of the most popular are installment loans and payday loans. While both can provide quick access to funds, they serve different needs and come with distinct repayment structures. At EasyFinance.com, a BBB accredited business, our mission is to connect you with the best online lenders for up to $2000 loans, ensuring you choose the right option for your financial situation.

Understanding Installment Loans

Installment loans provide a lump sum that you repay over a set schedule typically in monthly payments over several months or years. They are ideal for larger expenses or situations where spreading out repayment makes budgeting easier. For borrowers with restricted access to credit in certain states, alternatives like online tribal loans can offer flexible terms outside of traditional state regulations.

Understanding Payday Loans

Payday loans are short-term, high-interest loans intended to be repaid in full on your next payday. They are designed for urgent financial needs, usually smaller amounts between $100 and $1000. For situations where speed is essential, EasyFinance.com can connect you with options like emergency loans that provide fast approval and same-day funding.

When to Choose an Installment Loan

Installment loans may be the better choice when:

- You need a larger amount of money, often over $1000.

- You want predictable monthly payments over time.

- You have a steady income that supports ongoing repayment.

- You prefer lower interest rates compared to payday loans.

Borrowers in states with competitive lending markets might also explore payday loans online direct lender options when installment loans aren’t available but quick funding is still needed.

When to Choose a Payday Loan

Payday loans can be useful for:

- Covering emergency expenses before your next paycheck.

- Situations where you can repay in full quickly.

- Small cash needs where an installment loan would be excessive.

If your car breaks down or a utility bill is overdue, options like same day loans online can be lifesavers — provided you have a clear repayment plan.

Cost Differences Between the Two

The key difference is cost. Payday loans often have much higher APRs, sometimes exceeding 400% annually, while installment loans tend to offer lower rates spread over longer terms. However, longer repayment periods mean more total interest paid over time. EasyFinance.com’s lender network includes both types, helping you compare real offers before committing, including solutions like cash advance with bad credit for those with challenging credit histories.

Impact on Your Credit Score

Installment loans often report to credit bureaus, meaning on-time payments can improve your credit history. Payday loans generally do not — unless you default, which could send the account to collections. Building positive credit is easier with structured repayment, though responsible payday loan use can still keep your finances on track. Borrowers may also benefit from vetted products like secure online payday loans that offer transparency and consumer protections.

How EasyFinance.com Helps You Choose

Our platform simplifies the process by matching you only with lenders who are licensed and compliant in your state. Whether you need an installment loan for a major purchase or a payday loan to bridge a short-term gap, EasyFinance.com ensures you see competitive offers. This includes state-compliant products like online loans no credit check for borrowers seeking flexible approval criteria.

Key Insights

- Installment loans are better for larger amounts and longer repayment terms.

- Payday loans provide quick cash for urgent, short-term needs.

- Costs and interest rates vary significantly — compare offers before choosing.

- Installment loans can help build credit; payday loans usually do not.

- EasyFinance.com connects borrowers to licensed lenders for both loan types.

FAQ

1. Can I switch from a payday loan to an installment loan?

In many cases, yes — refinancing with an installment loan can reduce repayment pressure and interest costs.

2. Are installment loans safer than payday loans?

They often have lower APRs and longer repayment terms, but both loan types require responsible use.

3. Do payday loans always have higher interest rates?

Generally yes, though competitive markets and trusted platforms like EasyFinance.com can help you find more affordable offers.

4. Will either type help my credit score?

Installment loans can build credit with timely payments; payday loans usually won’t affect your score unless sent to collections.

5. Can I get approved with bad credit?

Yes — options like loans no credit check are available through our network for qualifying applicants.

Loan Guides and Resources to Read

- Guide to Online Loans: No Credit Check Alternatives and Safe Options

- How to Build Credit After a No Credit Check Loan

- Emergency Expenses Guide: When to Use a $500 Payday Loan vs. Personal Loan

- Loan Strategy for Gig Workers: 2025 Guide to Getting Approved

- Navigating State-by-State Regulations for Online Loans

- Smart Use of Installment vs. Payday Loans

- How Online Loan Companies Evaluate You Without Hard Credit Pull

- Future of Online Lending: Trends for 2025 and Beyond

- Loans for Unexpected Medical Bills

- Saving on Car Repairs with Quick Loans

- Rebuilding Credit: Loans That Help vs. Hurt

- Loan Planning Calendar: Align Borrowing with Pay Cycles

- Loan vs. Line of Credit vs. Credit Card: Choosing the Best

- Loan Scams to Avoid in 2025