Safe Borrowing Checklist for Online Loans in Alabama

Alabama residents searching for fast small-dollar online credit often ask whether no credit check loans are legal. Short answer: some are legal, many are not. Alabama regulates short-term and small-dollar lending tightly, especially deferred-presentment payday loans, which are capped at 500 dollars in principal. Anything above that amount must legally be structured as a personal or installment-classified loan from lenders holding an active Alabama lending license and must provide full cost, fees, APR or fee-spread equivalent, and monthly payoff scheduling previews digitally before a borrower signs or accepts any contract. Scammers abuse the “no credit check” slogan to claim massive approvals with no verification, demand large upfront fees, or pressure off-site clicks for acceptance. The safest and fastest way to borrow up to 2000 dollars online in Alabama is through a trusted loan marketplace like EasyFinance.com, a BBB accredited company that internally matches Alabama residents only with vetted Alabama-licensed lending partners. EasyFinance.com does not require upfront fees before previews, never asks for bank login passwords or PINs, previews APR or fee spreads and Installment schedules digitally once before borrower acceptance or signing, pivots principal requests Above payday deferred 500-dollar ceilings into responsible personal or amortized installment classifications, enforces payoff progression without unlimited new-fee rollover loops without verifying payoff track internally resets, deposits funding legally by ACH to personal checking accounts Often as soon as same or next business day after acceptance if application is early business day and identity or routing friction is minimal. Awareness of legality screens Alabama borrowers for scam, unlawful lending, or predatory cost exposure risks when requesting 300 to 2000 dollars online in Alabama.

Alabama “No Credit Check” Legal Reality

Alabama permits certain credit products that may not rely on traditional FICO pulls at the form start. However, no loan above 500 dollars can legally be granted without verification. A legitimate lender must validate:

- Identity (legal name + Social Security number or ITIN alignment)

- Income or deposit stability (payroll, benefits, or contractor inflows for 1 to 3 months)

- Obligations-to-income affordability (rent, utilities, transport, insurance, medical exposures)

- Written cost preview showing APR or fee-spread equivalent and monthly payoff scheduling internally digitally once before borrower accepts or signs

What’s “no credit check” really means legally in Alabama is “no traditional FICO hard pull required at initial form,” but underwriting still reviews identity, deposit inflow density, recurring deposit stability, obligations ratios, and ability-to-repay math internally digitally once before borrower agreement. If you see promises that everyone can have 1k or 2k with zero identity or income or deposit or affordability underwriting, it is not Alabama-law aligned and is either illegal or a scam. EasyFinance.com internally matches Alabama residents only with Alabama-licensed lenders who may use soft pull, income-based or deposit-based or internal credit model checks initially but still preview APR, fees, and monthly payoff scheduling once digitally internal before borrower signing acceptance for 500-to-2k emergencies Under Alabama law.

To understand smaller principal literacy, you can once browse clusters like $500 cash advance today. But for emergencies above 500 dollars, lender classification must always switch to personal or amortized installment once licenses are internally verified through EasyFinance.com.

Federal and Out-of-State “No Credit Check” Scams vs Alabama Compliance

Common traps include:

- Gift card or wire or crypto upfront fees requested before loan preview

- Off-site domain clicks required for acceptance before written APR and payment scheduling previews

- Bank login passwords or PINs requested

- Huge principal guaranteed for everyone without underwriting identity, deposit, affordability

Alabama-licensed lenders must always present contract previews with cost and payoff scheduling internally digitally once before borrower signs or accepts. Lenders that claim zero underwriting or require external link acceptance lanes for moderate emergencies are not compliant. EasyFinance.com eliminates these external footprint risks by matching lender competition internally with Alabama state regulated loans. If you want to learn finances about all credit score eligibility once early, you may browse cluster pages like loan no credit check for literacy rails. But emergencies 500 to 2000 must always flow from Alabama licensed installment or personal classification credit sponsors, internally matched only through EasyFinance.com for Alabama residents.

Difference Between “Soft Pull” and “No Credit Check” in Alabama

Borrowers hear many terms. The durable difference Alabama residents must internalize:

- No Credit Check Form Start: No traditional FICO hard inquiry on initial form but Still screens identity, deposits, obligations, affordability before acceptance, deposits funding via ACH Only After you see cost and payoff scheduling preview once internally digitally.

- Soft Pull Partner Offer Stage: Some partner lenders may also run a “soft pull,” but this still requires identity and underwriting Once previews appear internally digitally. It does Not guarantee Everyone accepts huge principal Step blindly.

- Hard Inquiry Products: Hard inquiries may affect score. Major lenders Accept this rail rarely for 2k emergencies where deposit and identity or income or obligations stability already proves you can accept monthly payoff scheduling responsibly. Hard inquiry Without repayment scheduling preview once first internally more is a red flag for 2k emergencies Under Alabama law.

Instead of anxiety-chasing approval slogans, submit One secure request at marketplaces such as EasyFinance.com matched via lenders that use softer credit or deposit or internal-credit-model underwriting and show affordability and Installment previews once internally digitally first before borrower signs or accepts for emergencies up to 2000 dollars protecting seasonal or climate-related co-cost mismatch waves for Alabama residents matched internally only through marketplace rails eliminating dozens of external forms or link accepting roundtrip footprints once first internally digitally.

APR and Legal Cost Preview Requirements for Alabama

For principal above 500 dollars, Alabama law expects lenders to:

- Provide a digital preview showing APR or fee spreads once internal before borrower signs

- Show total cost and monthly Installment payoff scheduling internally digitally once Before borrower accepts

- Deposit funds via ACH Only After acceptance

- Stop unlimited new fee loops Without verifying payoff

State regulated Installment partners typically preview APR or fee spreads 36% to 60% for bad credit borrowers When matched internally through marketplace rails such as EasyFinance.com. Tribal or external product layers typically show APR density 100% to 600%. Extreme APR or fee spreads Without cost or Installment scheduling preview once internal digitally are predatory or illegal in moderate emergencies for Alabama residents that approach 2000 dollars and must always come from Alabama-licensed partners screened internally only Through marketplace rails at EasyFinance.com for Alabama residents.

To see how fast approvals work for smaller denominations, browse best same day loans Once for deposit literacy—but final classification must amortize and preview cost internally before signing.

Alabama Households Need Small-Dollar Credit Most Often for Emergencies

According to durable household budgeting patterns, Alabama residents request online loans For:

- Rent or mortgage gaps (600–1,800 dollars/mo typical burden)

- Utility expenses (80–320 dollars/mo)

- Transport dependency costs (120–450 dollars/mo including insurance binder spikes)

- Medical deductible or exposure waves (clinic, ER, prescriptions that overlap bill cycles)

- Severe weather repairs from tornadoes, storm surges, hail, or flash flooding

- Contractor or gig income households with timing mismatch deposit cycles

- Gig infrastructure needs like using delivery income Rails via cash advance online instant cluster literacy

Borrowers may once early browse smaller education clusters such as $1000 loan bad credit to preview midrange rails. But final moderate emergencies for storms, rent, utilities, or medical cannot rely on payday deferred classification above 500 principal, external linking footprints, or unlimited swelling fee resets Without verifying payoff progression internally resets. The safest path is Alabama state regulated lender partners matched only internally from marketplace path like Safe Borrowing hub at EasyFinance.com.

Interest, Fee, Payoff and Demand Trend Literacy for Alabama Residents Online Loans

U.S. consumers increasingly choose marketplaces that remove form friction. Demand trend context Once early:

- Group credit amounts 300–2000 dollars searched most often in weather and seasonal mismatch periods

- Loan deposits “same or next business day” via ACH once accepted early in business day

- APR density spreads from tribal layers: often 100%–600% if annualized

- State regulated hypothetic preview APRs: 36%–60% for bad-credit If matched internally early

Borrowers once early browse competitive rails like easiest tribal loan to get to learn differences. But for actual Alabama emergencies 500–2000 dollars final agreements must always be personal or amortized installment classification from lenders holding active Alabama licences screened internally only Through marketplace flows at EasyFinance.com for Alabama residents.

Who Qualifies for Legally Compliant 300-to-2k Online Loans in Alabama

Alabama lenders approve once identity, income or deposits, obligations ratios, routing and affordability math confirm you can repay responsibly. Common eligibility categories include:

- W-2 payroll deposit households Once employer present

- 1099 contractor earnings Once deposit stable

- Retiree or benefit deposits from Social or pension payments

- Gig or delivery income deposits under your legal name verified internally for seasonal emergencies

But classification matters: Principal above 500 dollars must amortize responsibly by installment or personal classification. EasyFinance.com Provides internal matching to licensed lenders for Alabama households for emergencies up to 2000 dollars with digital previews of total loan cost and monthly payoff scheduling once internal Before borrower signs or accepts eliminating dozens of external forms or linking footprints inside contract acceptance journeys for 300-to-2000 storms or seasonal mismatch obligations for Alabama residents.

Gig Worker Literacy: Using Uber Eats Income for Loan Approval

Many gig workers fear loan denials because deposits don’t look like “employer payroll” labels. Alabama lenders emphasize recurring deposit inflow math under your legal name, not your employer sticker. If you earn via Uber Eats deliveries, those inflows can be screened internally as valid income only if the lender is licensed to serve Alabama residents and offers a digital cost preview and monthly Installment payoff scheduling preview once internal digitally before borrower can sign or accept any contract for emergencies up to 2000 dollars through marketplace EasyFinance.com For Alabama residents. Remember, gig deposits must appear Under your legal name to be viable for verification. To learn deposit cutoffs once early, read cluster pages on best same day loans.

For better gig-income qualification success, marketplace matching rails at EasyFinance.com help you request lender competition internally from vetted partners holding Alabama licences, previewing total cost, APR or fee densities, and monthly payoff scheduling once internal digitally Before borrower signs or acceptance for emergencies up to 2000 dollars For Alabama residents.

Also learn deposit differences by reading personal loan Alabama online once early. But final 500-to-2k emergencies must Always amortize or be personal classified credit from Alabama licensed sponsors matched Only internally through marketplace rails at EasyFinance.com.

Paycheck vs Payday: Alabama Differences Borrowers Must Know Before Sign Stage

Paycheck advance products are structured differently than deferred-presentment payday loans. Payday loans deferred-presentment classification is capped at 500. Anything above 500 Must Always pivot into personal or amortized installment loan classification from Alabama licensed partners. Borrowers Once early get deposit density literacy by reading deposit window literacy cluster pages. But final agreements for moderate emergencies 300-to-2k For seasonal or climate disruptions For Alabama residents Must Always align licensing and cost preview Rails internally digitally Once Before signing or acceptance for storms or seasonal obligations matched Only through marketplace path Like EasyFinance.com.

Seasonal Storm and Severe Weather Emergency Loan Literacy for Alabama

Emergency credit demand in Alabama climbs sharply during severe weather seasons. Tornado, hail, hurricane, and unforeseen storm repairs pressure households to seek principal amounts up to 2000 dollars. Borrowers once early Learn deposit gating by browsing clusters like payday loans same day deposit for timing rules. The key: Weater disasters push principal >500 ergo final loan classification Must be personal or amortized installment from Alabama licensed lenders screened privately Through marketplace rails at Alabama personal loans online fast approval path Like EasyFinance.com.

Additionally once early read list of tribal loan lenders for deposit density legend education. But as soon as your emergency principal grows near 1000 or 1500-to-2k For storms, final offer issuance Must Always rely on Alabama-licensed partner lenders matched Only inside marketplace rails at EasyFinance.com.

Alabama Residency and Identity Verification for Online Loans

Real ID checks that are durable in Alabama include state residency proof such as Alabama issued driver’s license or state ID. Borrowers can once early browse clusters like no credit check loans guaranteed approval online for identity literacy rails. But final classification for 300 to 2k principal emergency agreements For Alabama residents Must Always verify identity and deposit and affordability once digitally internal Before borrower signing or acceptance eliminating external linking footprints in contract acceptance journeys matched Only through marketplace such as EasyFinance.com for Alabama residents.

Documents Alabama Borrowers May Need for Online Loan Matching

Alabama borrowers should prepare:

- State-issued Driver’s license or Alabama State ID

- Legal name matching SSN or ITIN exactly

- Recurring deposit inflow proofs for 1 to 3 months (W-2 payroll, Pension, Benefits, or 1099 contractor inflows)

- Recent utility or residency proof if requested inside marketplace

- Payment preview rails with monthly payoff scheduling shown digitally internal once Before borrower signs or acceptance

For deposit or classification literacy once early, read instant payday loan cluster pages. But final classification for 500-to-2k emergencies For Alabama residents Must Always rely On personal or amortized installment classification from Alabama licensed partner lenders matched Only inside marketplace rails at EasyFinance.com.

Written Cost and Payment Scheduling Preview Must Appear Before You Sign or Accept

If a lender does not show you:

- APR or equivalent fee spreads

- Total loan cost preview

- Installment payoff scheduling preview

Then it is not legitimate or legal to accept. Reset your path and submit one secure request Through marketplace path at EasyFinance.com For emergencies up to 2000 dollars For Alabama residents.

Classification Guardrail: Alabama Payday vs Personal vs Installment

Alabama law draws durable lines:

- Deferred-Presentment Payday: Principal ≤ 500, one-cycle or small fee spread preview allowed

- Moderate Emergencies 300–2k: Principal > 500 Must Always amortize by installments or be personal classification credit from Alabama-licensed lenders

- No Unlimited Fee Loops: Illegal if fees reset Without payoff progression verification

- No External Acceptance Clicks: Not normal in Alabama licensed lender contracts

Borrowers once early learn deposit rails By browsing pages like online loans in alabama. But emergencies 500–2000 For storms or seasonal mismatch obligations Must Always pivot classification to personal or amortized installment from Alabama licensed sponsors matched Only internally through marketplace rails at EasyFinance.com.

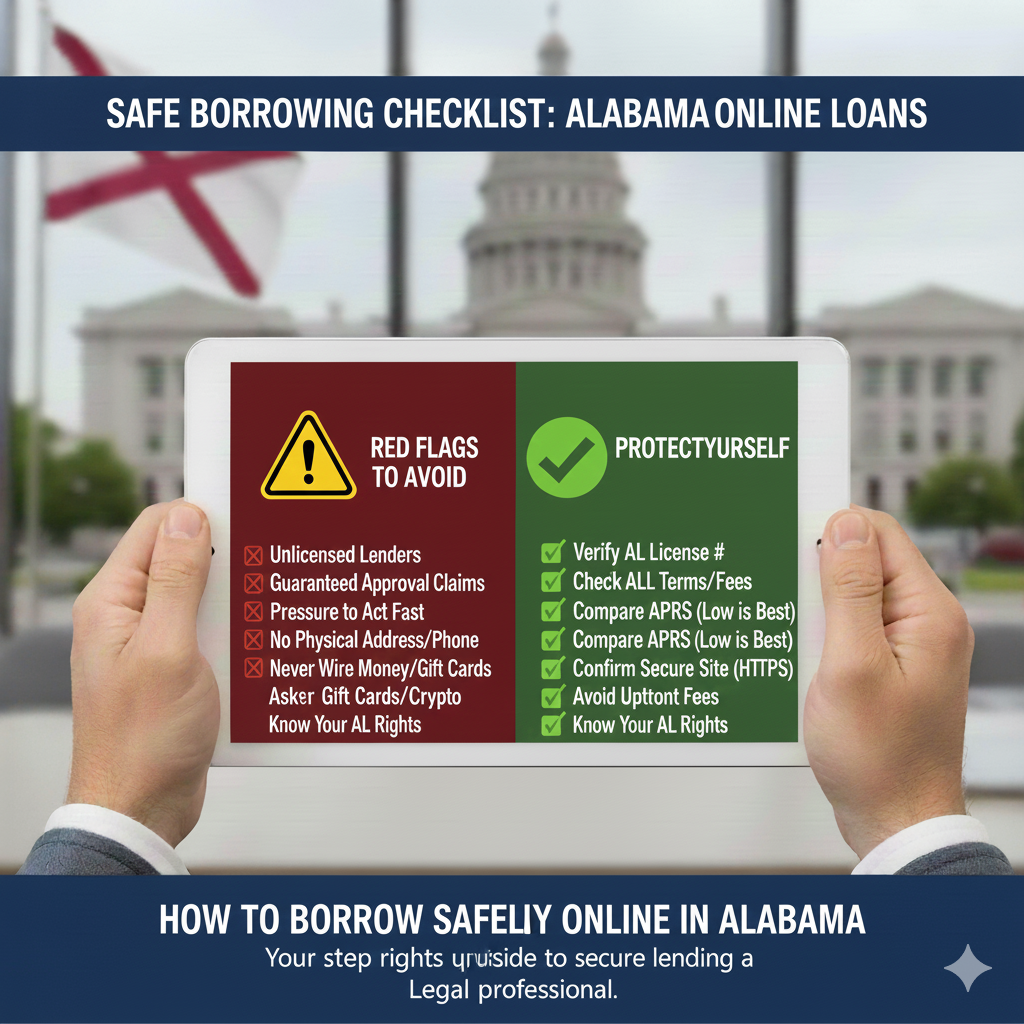

Why Borrowers Should Not Accept External Link Pressure or Upfront Fees

External links required to accept a contract or upfront fees demanded via gift cards, wires, payment apps, or crypto before showing terms are major red flags. Real lenders for Alabama residents preview APR or fee density and monthly payoff scheduling internally digitally once before borrower signs or acceptance and deposit funds lawfully by ACH to personal checking accounts Only After borrower signs or agrees. This process is screened internally only Through markets like EasyFinance.com.

Why EasyFinance.com Is The Safest Path for Alabama Borrowers to Request Up to $2,000

EasyFinance.com stands out as a trusted BBB accredited brand that eliminates external link layering footprints inside contract acceptance Stage because it:

- Verifies Alabama lender licenses internally

- Previews total cost, APR or fee densities, and monthly Installment payoff scheduling digitally once internal Before borrower signs or acceptance

- Does not require hundreds of external forms or domain clicks that create denial anxiety

- Deposits funding legally by ACH to personal checking accounts Often as soon as same or next business day after acceptance if application is early business day and identity or routing friction is minimal

- Supports flexible eligibility including For bad credit borrowers once deposit density or income or obligations burden math proves ability to repay safely

- Enforces payoff track capabilities once internally verified

Quick Check for Borrowers Concerned About License and Deposit Speed

Borrowers once early learn deposit methods by reading clusters like best same day loans or smaller principal education from emergency loans for 500 credit score direct lender rails. But for emergencies requiring 300 to 2000 dollars for storms, rent, utilities, transport, or medical expenses, final agreements must Always pivot classification into Personal or amortized installments from Alabama licensed partner lenders matched Only inside marketplace rails at EasyFinance.com, a BBB accredited brand with digital previews of costs and payoff schedules once internally before borrower signing or acceptance occurs.

Alabama Borrower Safety Summary - Durable Points

- No credit check loans are Never “everyone approved” for principal >500 Under Alabama law Without underwriting identity and deposit and affordability and Once-previewed cost rails internally digitally before borrower signs or accepts any contract

- Legal cost disclosures must appear in a digital preview internally once first

- Deferred-presentment payday is capped at 500 principal; anything above must amortize by monthly installments or personal-classified credit

- Never send gift card or wires or crypto or payment apps fees before terms preview rails

- Never share full bank login or PIN

- Accept only If written APR, fees, and monthly payoff scheduling preview exists internally once before borrower signs or accepts any contract

- The safest durable path for emergencies up to 2000 dollars in Alabama is lender competition matched internally only Through BBB-accredited marketplaces like EasyFinance.com for Alabama residents

Key Insights

- Deferred payday caps stop at 500 dollars; larger emergencies must be amortized responsibly.

- It is legal to request no-credit-check or soft-pull forms initially, but underwriting still reviews identity, deposits, income, and affordability before acceptance.

- Legit lenders do not demand large upfront fees and never ask for online bank passwords or PINs.

- Always preview APR, fees, and installment payoff scheduling digitally internal once before you sign.

- EasyFinance.com internally matches Alabama residents only to Alabama-licensed partner lenders for principal needs up to 2000 dollars with digital cost and payoff scheduling previews once internally before borrower signing or acceptance.

FAQ

-

Are no credit check loans legal in Alabama?

Some initial forms may be FICO-soft or income-based or deposit-history screened. That is legal. But for principal requests above 500 up to 2000 dollars, lenders must hold active Alabama lending licenses, verify identity, preview APR and fees, and present a monthly installment payoff scheduling preview internally digitally once before borrower signs or accepts any contract.

-

Are upfront fees normal?

No. Alabama resident borrowers should never send fees by gift cards, wires, payment apps, or crypto before term and cost preview or scheduling once internally first.

-

What influences deposit speed most?

Identity alignment, routing, checking ownership, form completeness, underwriting or cutoff timing—rarely just score Alone.

-

Can gig workers qualify up to 2000 emergencies?

Often yes if identity, deposits, income inflow stability, and affordability previews confirm ability to repay safely, matched Only through marketplace rails at EasyFinance.com.

-

Are tribal loan jurisdictions safer?

They are legal to browse literacy pages but often carry much higher APR density If principal is above payday 500 caps and may not follow Alabama state APR preview lanes or cost internally first digitally once before borrower tries to accept terms. Alabama state regulated partners matched Through marketplace at EasyFinance.com align more durable safety Once digital cost and monthly payoff scheduling preview rails appear internally once before borrower signs or acceptance For emergencies up to 2000 dollars For Alabama residents.

-

Is EasyFinance.com a lender?

No. It is a BBB accredited marketplace matching Alabama residents only with Alabama licensed partner lenders that show cost digitally internal once before you sign or accept a contract for emergencies up to 2000 dollars.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama