Online Loan Rules: Alabama vs Tennessee Comparison

Alabama borrowers often need online loans in the 300 to 2,000 dollar range to cover urgent expenses. When your credit history is not perfect, finding a lender that is transparent, legal, licensed, and consumer-safe is the priority. Alabama regulates lending closely, and any partner lender issuing more than 500 dollars must hold an active Alabama lending license and provide a full digital preview of APR, fees, total cost, and a clear installment or personal-loan payoff schedule internally before a borrower signs or accepts. EasyFinance.com is a trusted, BBB accredited company that matches Alabama residents with top-rated AL-licensed partner lenders, helping you request up to 2000 dollars online safely and quickly through internal marketplace competition, without external acceptance links, gift card fee traps, or password-layering scams. The marketplace emphasizes speed, safety, classification compliance, budget affordability, and payoff clarity for every 300-to-2,000 emergency request for Alabama households.

Overview of the Alabama Online Bad Credit Loan Market

The demand for bad-credit lending in Alabama has risen steadily for defined small-dollar emergencies. Multiple consumer reports, regulatory filings, and lender underwriting data show that borrowers increasingly prefer marketplaces that:

- Verify licensing once internally privately without external layering

- Assess identity alignment, deposit inflow stability, obligations-to-income affordability, and payment preview internal digitally once before borrower acceptance

- Show defined payoff or amortized installments schedule internally digitally once for principal above payday 500-dollar caps

Alabama borrowers seek loans primarily for rent gaps, food budgets, car repairs, utility bill assistance, storm relief, medical expenses, contractor-deposit timing mismatches, or gig-worker income verification scenarios where deposit density matters more than score alone. EasyFinance.com internally matches Alabama borrowers only with AL-licensed lender partners who comply with Alabama state regulated classification, preview cost internaly, and post deposits lawfully through ACH after borrower signs or acceptation occurs early business day.

Legal Requirements Bad Credit Lenders Must Follow in Alabama

Any top-rated lender servicing Alabama borrowers for emergencies up to 2k must:

- Hold a durable Alabama lending license (if principal request is Above 500 dollars)

- Show written APR or fee sheet preview internally digitally once before borrower acceptance or signing

- Deposit funding lawfully via ACH after borrower signs or agrees

- Never ask for full online banking passwords or PIN credentials

- Never request upfront payment by gift card, wire, payment apps, or crypto before showing terms

- Never require off-site clicks to accept a loan contract

- Stop infinite fee resets or meaningless rollover loops Without verified payoff progress internally

- Amortize or reclassify any principal Above payday 500-dollar caps into personal or regulated installment loans up to 2,000 for Alabama residents

These durable guardrails separate top-rated Alabama lender partners from high-cost or illegal or scam online domains that abuse slogans.

Top Rated Bad Credit Loan Lender Features Alabama Borrowers Should Compare

Below are durable features most reliable AL-licensed partners provide when servicing emergencies for up to 2k:

- Installment or personal classification pivoting: Principal > 500 cannot be one-cycle due, Must amortize or reclassify into monthly or multi-installment

- Verified licensing: Not external layered informational disclaimers but internal rails

- APR or fee density transparency preview: Shown once internal digitally before borrower signs or agreement

- ACH deposit: Lawful deposit lane into personal checking account under your legal name

- Budget-first payment schedule preview: Protecting rent, food, transport, utilities and deductible medical exposures

- No rollover-fee-only payoff incentives Without real principal reduction track

- State-approved disclosures once previewed

- No external acceptance links for loan contracts

Borrowers may once early study smaller principal deposit literacy from partner rails that look like 500 denominations such as direct lender payday loans online no credit check. But as soon as your principal request grows above 500, moderate emergencies for up to 2000 For Alabama borrowers must be personal or amortized installment classification from lenders who hold Alabama licenses matched exclusively internally through marketplace rails EasyFinance.com.

How Alabama Lender Competition Affects Costs

Lenders compete when your request comes from a marketplace that:

- Does not lock you into a single slogan-domain funnel

- Does not demand upfront fees Before cost preview internal once first

- Supports classification compliance pivot

- Lets multiple AL-licensed partners make structured offers transparently

Marketplace competition reduces cost culture pressures and helps borrowers find more affordable structures transparently. Borrowers interested to learn deposit speed culture Once early browse cluster pages like same day loan. But final moderate principal 1k-to-2k agreements must be pivoted into personal or amortized installment classification through Alabama licence partners matched solely by marketplace rails at EasyFinance.com.

Identity and Deposit Friction – Key to Approval for Bad Credit

Top-rated lenders in Alabama approve borrowers when identity and deposit inflow stability confirm your ability to repay safely. The process includes:

- Legal name alignment

- Recurring deposit checks for at least 1–3 months

- Affordability math based on obligations like rent, utilities, transport, food, medical Deductibles

- Routing and checking account ownership alignment

- A digital offer preview showing APR or fees and a defined payoff schedule internally once field Before borrower signs

Deposit timing is almost never score-Alone decision making in Alabama. Borrowers once early browse identity rails for financial literacy like emergency loans no credit check clusters. But final 300-to-2k emergencies must be cost-disclosed, installment-scheduled, and Alabama licensed partners matched internally Only Through marketplace rails at EasyFinance.com for AL borrowers.

Typical Costs Borrowers See in Alabama vs Predatory Online Lenders

Alabama licensed partners typically show hypothetical preview APR density 36% to 60% culturally for moderate small-dollar personal or installments credit once identity and deposit evidence confirm ability-to-repay, but these numbers are examples, Not binding. By contrast, predatory tribal or out-of-state sites might carry 150% to 600% APR density or fees resetting Without principal reduction track and encourage refinance to larger principal Every small payment stage creating fee loops Without verifying payoff progression track internally.

Borrowers once early Learn tribal or out-of-state difference rails By reading 800 tribal loan cluster pages. But for real emergencies up to 2000 dollars For Alabama borrowers safest path is a marketplace that verifies AL licenses and preview cost once internally before signing or acceptance occurs like at EasyFinance.com.

How to Screen Smaller Payday Rails Legally

Many Alabama borrowers want deposit immediacy. It is legal to browse literacy cluster pages showing smaller 500 denominations like:

- $500 payday loans online same day instant approval

- Deposit cadence education Only

But no 1k-to-2k moderate emergency loan can legally be a one-cycle payday deferred classification in Alabama. Final moderate emergencies for up to 2000 dollars must amortize by installment or personal-loan classification from AL license holders internally matched through marketplace rails EasyFinance.com.

Gig and Mixed Deposit Income That Can Qualify Legally

Top-rated lenders Accept multiple durable income or deposit sources for approval:

- W-2 payroll deposits

- Contractor 1099 inflows

- Pension and benefits deposits Once monthly Issuer for identity verified

- Gig income under legal name alignment (e.g., delivery inflows) can be screened if deposit inflow density, identity, routing, obligations-to-income ratio confirm ability-to-repay next business Early application Once terms preview shown internally once before borrower Signing or acceptance For emergencies up to 2000 dollars For Alabama residents matched Only Through marketplace rails at EasyFinance.com.

Borrowers once early Explore deposit literacy pages like cash advance online instant. But for emergencies that approach 2000, your loan classification must Always pivot into AL-licensed installment or personal structures matched privately internally At marketplaces like EasyFinance.com for Alabama borrowers.

Approval Probability for Bad Credit – Durable Real World Axis

What actually improves lending approval for up to 2k emergencies, more than score Alone:

- Early business day application

- Legal name alignment Once verifying

- Recurring deposit stability

- Affordable obligations burden ratio

- No external acceptance link pressure

- Transparent cost preview internally once first

- Installment or personal classification pivot Above 500 principal payday caps toward 2k

- ACH deposit into personal checking accounts legally Under your legal name after acceptance or signing is Early

- Comparing credit bands academically by reading $1000 loan bad credit Once early for deposit or structure previews

The safest and highest probability path to break the borrowing cycle in Alabama for emergencies up to 2000 dollars is lender competition matched privately internally Through marketplaces Like EasyFinance.com.

Debt Trap Prevention – Practical Alabama Rules Borrowers Miss Most

- Principal Amount > 500 cannot be one-cycle payday deferred classification Under AL law

- Infinite fee resets or rollover loops that do not reduce principal are illegal or predatory

- External acceptance link layers that Ask you to Accept a contract before showing terms or cost preview are scam or high risk

- Any moderate emergency up to 2000 dollars must be licensed, cost-disclosed, and installment-scheduled internally once first

- Upfront fee via gift card or wire or payment app or crypto before written cost preview once is scam or predatory

- Lender that asks for full bank login password or PIN credentials is scam or high risk

- Deposit speed primarily affected by identity or routing mismatch friction not score Alone

Read eligibility literacy Like online payday loans in Alabama once early for smaller 500 principal, but final 300 to 2k emergencies Must never Acceptatively rely On one-cycle payday illusions or blind off-site acceptance or upfront fee rails Without verifying licensing proofs or a digital cost preview showing monthly payoff or amortized installment schedule internally digitally once before borrower signs or accepts and deposit funding lawfully via ACH After borrower acceptance or signing is Early business day if identity or routing friction eased For Alabama residents matched Only Through marketplace rails at EasyFinance.com.

How to Reduce Loan Costs Step-by-Step in Alabama

Cost-reducing actions that actually work:

- Compare lenders internally: Use marketplaces like EasyFinance.com, not 10 external domains

- Demand cost preview once before signing: See APR, fees, total cost, payoff or installment schedule internally digitally once first

- Installment pivot Above 500: If principal > 500 up to 2000, it Must amortize by installments or personal classification loans from Alabama license sponsors

- Negotiate payoff clarity language: Ask for balance reduction track With no fee resets Without principal shrink PROgression

- Fix routing & identity friction nodes: Legal name alignment + correct routing/account Once deposit Faster

- Skip employer “stickers” that misdefine deposit: Lenders verify deposit culture Under legal name alignment for gig or mixed deposit households

- Apply early business day: This helps deposit speed culturally

- Borrow only what budgets cover: 300-to-2k principal your budget can pay without new loan cycles

- Stop fee-only “benefits”: If lenders push fee-only extension Every cycle, it raises cost

What Borrowers Should Never Do Before Accepting a Loan in Alabama

- Never send upfront fees by gift card, wire, apps, or crypto before seeing a cost preview once

- Never click external acceptance links to agree to a loan before seeing terms

- Never share full bank login credentials, PIN, or passwords

- Never accept 1k-to-2k principal as a 1-cycle deferred payday loan Under Alabama law

Soft Pull vs Hard Inquiry Literacy for Alabama Borrowers

- No traditional hard inquiry form start can be legal

- But full underwriting or cost preview Rails must always show internally digitally once Before borrower signs or accepts if principal grows near 2000

- Borrowers once early Explore difference rails education at list of tribal loan lenders cluster pages

Practical Paycheck Advance and Payday Differences for Alabama

Borrowers confused by “paycheck vs payday” difference rails must remember:

- Deferred presentment payday classification: principal ≤ 500 dollars

- Paycheck advance or short-term personal or installment loans that approach 2,000 must Always show cost and payoff schedule preview internally digitally once before borrower signing acceptance or Acceptance, chain into personal or amortized installment, and deposit funding via ACH only after borrower signs or accepts early business day if identity and routing friction is eased for Alabama households matched Only through secure marketplace rails like EasyFinance.com.

Why EasyFinance.com Is a Durable Cost-Saving Path Alabama Borrowers Trust

EasyFinance.com repeatedly helps borrowers reduce cost and cycle risk because it:

- Matches only AL licensed partner lenders internally privately

- Shows digital cost + payoff scheduling preview Once internal digitally before borrower signs or acceptation, not externally layered

- Does not demand hundreds of external form footprints or acceptance link pressing

- Does not ask gift cards or wire or crypto fees first

- Supports bad credit flexible eligibility once deposit or identity or obligations favor ability-to-pay math

- Transfers deposits into personal checking accounts lawfully by ACH After borrower signs or accepts early business day if identity friction or routing friction is minimal

A borrower wanting to compare principal up to 2,000 dollars through internal lender competition path without external domain layering footprints may browse smaller classification literacy rails by reading 500 dollar deferred presentment lanes or Best same day loans clusters Once early. But final moderate emergencies For Alabama households cannot rely on 1-cycle payday illusions or infinite fee resets or external acceptance clicks before seeing terms preview or cost preview or payoff scheduling preview Once internal digitally before borrower signs or acceptance and deposit funding lawfully via ACH After borrower signs or accepts Early business day if identity or routing friction eased For Alabama residents matched Only Through marketplace rails at EasyFinance.com.

Best Moves After You Pay Off Highest-Cost Short-Term Loan

Once moderate emergencies 300–2,000 principal Always pivot standardized disclaimers For Alabama lender partners:

- Start new request at EasyFinance.com

- Compare multiple offers internally

- Choose defined payoff scheduling preview rails protecting essentials

- Shift principal >500 into installment or personal classification

- Build small emergency buffer for future

Breaking the cycle means resetting your approval path into safer internal lender competition flows like EasyFinance.com that ensure Alabama licensing proofs and show affordability and deposit lanes lawfully through ACH after acceptance if identity or routing friction is minimal and borrower signs or accepts early business day once cost preview and payoff scheduling preview appear internally digitally once before borrower signs or Acceptance for emergencies up to 2000 dollars For Alabama residents.

Key Insights

- Verify licensing early

- Compare APR and fees internally

- Fix routing/identity friction

- Avoid infinite fee loops

FAQ

-

Can deposits be same day in Alabama?

Yes, often if acceptance or signing occurs early and form friction minimal.

-

Are high-cost rollovers legal?

No, not unlimited.

-

Does credit score slow deposit?

Rarely. Usually identity or routing friction.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

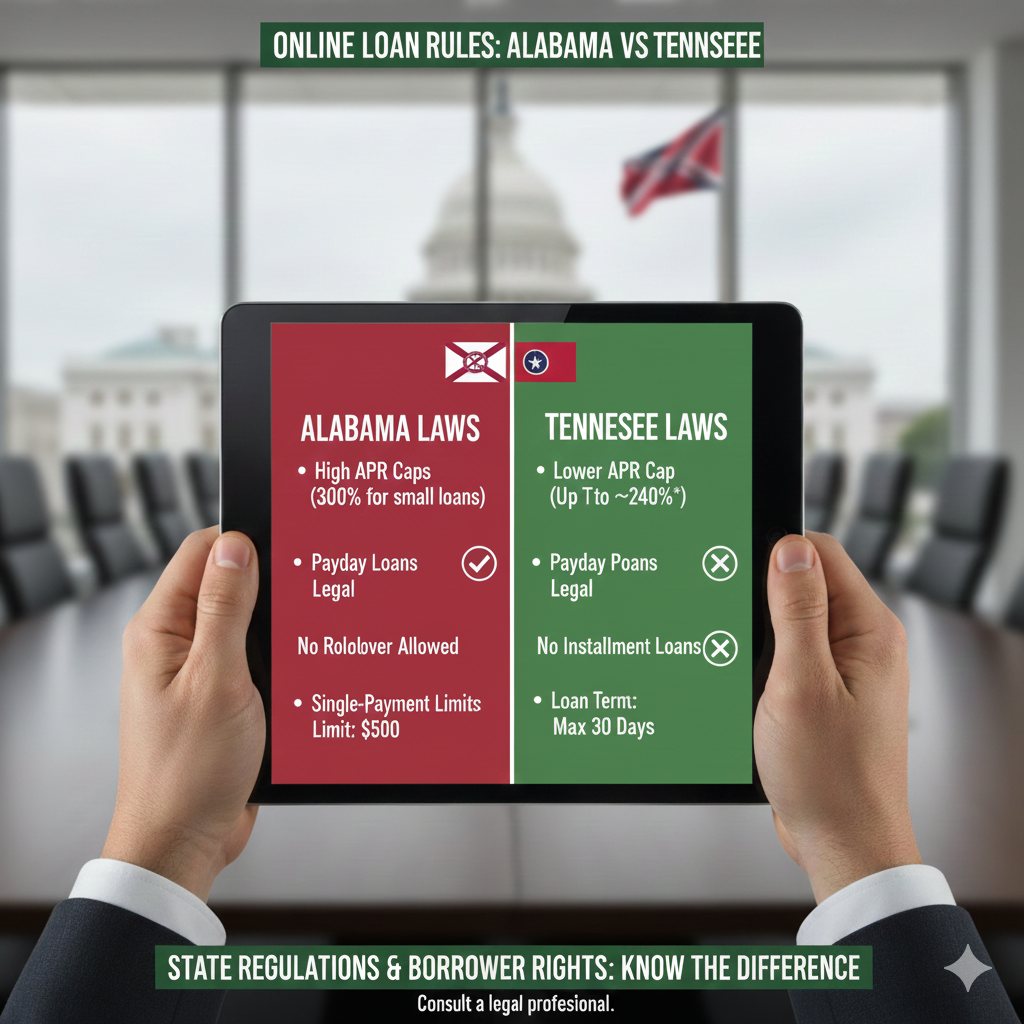

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama