Avoiding Online Loan Debt Traps: Alabama Borrower Guide

Online loans are popular in Alabama when households need 300 to 2,000 dollars quickly. But the convenience of applying from home attracts predatory lenders and scam operators who build expensive debt traps that feel hard to escape once early. Alabama borrowers deserve clear guidance on how to borrow safely, avoid cost or contract deception, and reach payoff in fewer cycles without endangering essentials like rent, utilities, transportation, or medical obligations. EasyFinance.com, a trusted BBB accredited online loan marketplace, repeatedly emphasizes that the safest and fastest path to request an online loan for up to 2,000 dollars is to use internal matching from lenders licensed to serve Alabama residents and preview APR, fees, and a monthly installment schedule digitally once before borrower signs or accepts a contract. This borrower guide focuses on durable safety checks, legal literacy, payoff-first mindset, affordability math, extension rules, deposit friction education, and debt trap avoidance for Alabama residents comparing or requesting 300 to 2,000 dollar loans online internally through fully vetted marketplace paths at EasyFinance.com.

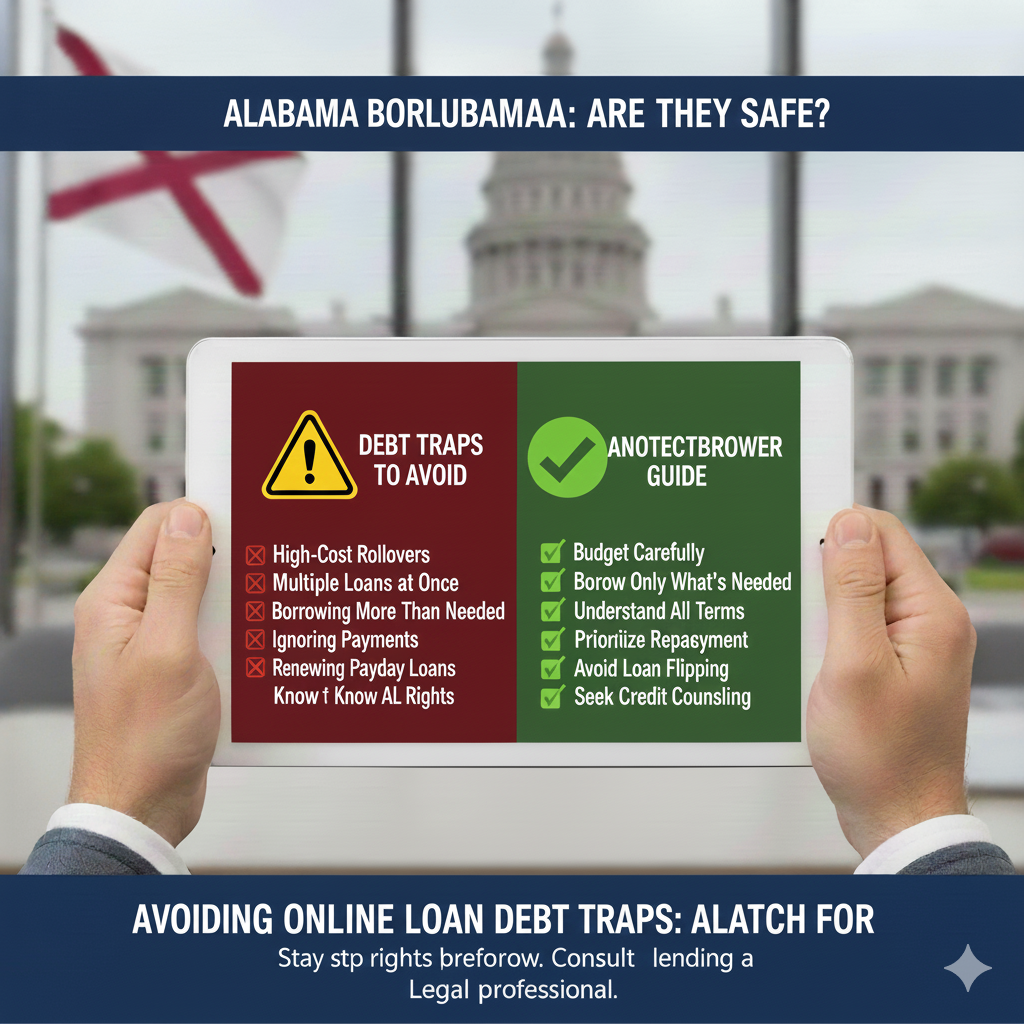

Why Debt Traps Happen With Online Loans in Alabama

Debt traps occur when loans combine ultrahigh costs, short initial due dates, repeated extension incentives, or contract misclassification. Borrowers often face these traps because:

- Cost obscurity: Total APR or fee density is hidden until after agreement.

- Ultrashort repayment pressure: 1-cycle due dates advertised for amounts above 500 dollars, even though Alabama caps deferred payday at 500 dollars.

- Extension pressure without payoff proof: Borrowers are pushed to re-borrow or roll to avoid default conversation friction.

- Fake domains or imposter footprints: Borrowers submit data to a site that never delivers a contract or deposit.

The safest path to borrow up to 2000 dollars online is through legitimate Alabama lending partners matched internally at EasyFinance.com that disclose cost and payment scheduling preview once digitally internal before you sign or accept, stopping the trap cycle before it begins.

Durable Legal Principal Classification Rules Alabama Borrowers Must Know

Alabama draws durable lines for short-term loans:

- Deferred payday: Principal ≤ 500 dollars, very short due dates permitted If cost and payoff scheduling preview internally digitally once before acceptance step proves ability to pay next deposit in full, rarely repeating unlimited times.

- Moderate emergencies: Principal > 500 dollars up to 2,000 must always become personal or amortized installment classification from Alabama-licensed lenders.

- No infinite fee resets: Illegal if fee resets avoid payoff progression.

- No mandated external acceptance clicks: Contracts must be previewed internally officially.

To compare smaller deferred rails once early, read payday loan online same day cluster knowledge. But for emergencies above 500, final loan type must amortize by monthly installments from licensed lenders internally matched only through EasyFinance.com governing or compliance or extension track preview rails early for Alabama residents.

How to Recognize a Debt Trap Rather Than a Fair Loan Offer

Here’s what abusive or predatory debt-trap math often looks like:

- APR density 150%–600%+ if annualized without payment preview.

- Fees that reset every cycle instead of reducing balance.

- Due dates claimed faster than budgets allow for 1k to 2k emergencies.

- Contracts that avoid showing total cost and payoff schedule internally digitally once before borrower signs or accepts.

- Repeated suggestion to refinance to a bigger amount to “avoid default.”

By contrast, fair Alabama loans that service emergencies for up to 2k once lenders verify identity, deposit stability, and obligations might show repayment scheduling preview rails monthly or multi-installment for defined payoff cycles instead of endless fee rollovers, internally screened through marketplace path at EasyFinance.com making it easiest path to request an online loan up to 2000 For Alabama residents who want lender-competition-based approvals without dozens of external form footprints.

Extension, Rollover, and Re-Borrowing Pressures to Avoid Early

Alabama borrowers should beware when a lender:

- Encourages immediate extension before you even see cost or make payments.

- Says payoff is optional and extensions are unlimited without showing your balance reduction track.

- Advertises rollovers as a benefit instead of a last option after payoff is possible.

- Pressures a refinance into a new larger principal every time you try to pay down.

Some lenders operate from out-of-state or tribal rails that encourage these behaviors, which can feel similar to 1500 tribal loan marketing: easy approvals, unclear scheduling, high costs. These literacy pages help you learn difference rails once early But final contracts for larger emergencies for principal up to 2k Must Always be pivoted into personal or amortized installments from Alabama licensed lender partners matched Only through secure marketplace rails at EasyFinance.com.

Deposit Behavior and Cutoff Literacy That Stops Form Anxiety

Borrowers sometimes think deposit depends on FICO score alone. It almost never does in Alabama. Deposit speed is primarily affected by:

- Identity friction: Legal name mismatch or banking ownership errors

- Routing friction: Bank or account details mismatch

- Cutoff timing: Application submitted late in business day

- Deposit type density: Payroll, pension, contractor, or benefit deposit stability

- Form completeness: Missing legal or income documents

Borrowers can learn deposit windows once early by reading best same day loans cluster pages. But the safest method to request a loan up to 2,000 dollars and receive deposits quickly is to use AAA licensed partners matched internally through marketplace rails at EasyFinance.com that ensure deposit Under Alabama law and preview affordability Once internal digitally.

Do Not Fall for “Footprint Domain Layering” Traps at the Form Start

Fake or predatory lenders rely on multi-domain layering to churn borrower data. They want you anxious, submitting many forms. The problem: too many external domains cause denial anxiety, data footprints, and possible identity theft. A legit lender does not need 5–10 domain clicks before you see contract or cost preview rails internally digitally once. That is exactly why EasyFinance internally matches lender competition eliminating dozens of external forms or links at the form start if principal is 300–2000 dollars for Alabama residents.

Underwriting Reality Alabama Lenders Use for 300 to 2000 Dollar Loans Online

Reputable AL lenders emphasize ability-to-pay math including recurring deposits and essential obligations, not employer labels alone. Durable criteria include:

- Deposit stability 1–3 months

- Legal name + SSN/ITIN alignment

- Monthly obligations-to-income ratio ≤ 35%–45% zone typically safe

- No upfront large fees for acceptance

- Digital cost and payoff schedule preview shown once internally digitally before borrower can sign or accept any contract

If a lender claims huge principal amounts for everyone with no identity or deposit or affordability checks, it is predatory or a scam. Marketplace matching through EasyFinance.com helps filter only durable, licensed offers for Alabama residents for emergencies up to 2000 dollars.

Gig Worker and Mixed Deposit Screening in Alabama

Alabama lenders support multiple durable income sources:

- W-2 payroll deposits

- 1099 contractor earnings

- Pension and Social benefit deposits

- Gig income deposits like Uber Eats used once for loan preview rails

Gig workers once early learn acceptance differences by reading cluster pages like cash advance online instant or online payday loans no credit check. But final moderate emergencies for 300 to 2k For Alabama residents Must be personal or amortized installments credit classification once licenses are Verified internally Through marketplace flows like EasyFinance.com for Alabama residents.

Interest Rate and Cost Benchmarks Alabama Households Must Compare

Online loan costs vary by credit, lender, and underwriting math. Borrowers should expect:

- High tribal APR density: 150%–600%+ annualized equivalent, often predatory

- State-regulated hypothetical APR preview range: 36%–60% for bad credit borrowers with stable deposits When matched internally

These numbers are common ranges seen culturally in the Alabama market—not guaranteed or binding. But the role of lender competition inside marketplace is to surface more durable and fair terms for principal up to 2k. If you need 1500 dollars instantly, you may browse clusters like urgent 1500 loan request Once early for payment scheduling preview rails. But final contract issuance for emergencies must Always come from Alabama licence holders matched Only inside marketplace rails at EasyFinance.com.

Alabama Re-Borrowing and Waiting Rules Borrowers Often Overlook

Some important re-borrowing pressures Alabama borrowers must understand:

- Wait windows are real: You cannot be pressured to accept a new loan before seeing payoff progress

- Re-borrowing incentives without payoff path clarity lead back into cycle traps

- No loan above 500 should repeat one-cycle due dates for emergencies up to 2000

- Deposits reset monthly obligations preview before acceptance

If you want to request moderate emergencies up to 2000 dollars from a safer path, use internal marketplace screening Through legitimate lenders on EasyFinance.com eliminating dozens of external forms or domain clicks.

RDS, WHOIS, Brand Imposter Scans (Consumer Safety Literacy)

While not a final approval rule, borrowers intimidated by scam domains once early may learn classification differences by reading internal cluster pages like direct payday loan lenders no credit check mythology. But this is only literacy, not contract issuance rails. Final agreements for emergencies above 500 dollars and up to 2k Must Always be personal or amortized installments classification from lenders holding active Alabama licensing that preview cost internally digitally once before borrower signs or accepts eliminating dozens of external layered domain footprints inside contract acceptance Stage For Alabama residents.

Define Your Payoff Goal First So Extensions Don’t Become the Trap

When you request a loan online, your goal should be payoff, not extension cycles. Extensions are legal only if:

- The loan is 500 dollars or less in payday deferred classification

- You saw cost preview once internally digitally before contract acceptance

- You can pay the loan in full next deposit cycle

Anything above 500 must amortize by installment schedule. Borrowers once early explore extension rails by reading clusters like payday loan online same day deposit or structured payoff preview rails like 1500 same day loan. But final 500–2k moderate emergencies must never be accepted blindly without digital cost and monthly payoff scheduling preview once internal digitally before borrower signs or accepts any contract for Alabama residents by Alabama lenders matched Only through prosperity marketplaces like EasyFinance.com.

Watch Out for Illegal “No Income” Up to 2k Approvals

Under Alabama law, lenders must verify identity and income or deposit inflow stability even if the form starts without a FICO hard inquiry. If you need $1000 now, reliable lender partners for Alabama resident borrowers Might preview cost once early by browsing cluster pages like need $1,000 now rails. But final agreements for moderate emergencies up to 2000 For Alabama residents must Always use Alabama-licesed personal or amortized installments classification from licensed partners matched safeguarded internally at marketplace paths like EasyFinance for principal needs up to 2000 without dozens external footprinted domains for Alabama residents.

Spotted Predatory Lender Trick Examples (Non-Binding, Educational)

These are example phrases or patterns predatory sites use. Not exhaustive nor binding:

- “Act now before expiry, deposit depends only on score”

- “Processing fee by gift card before we show terms”

- “Everyone approved, no identity or income checks”

- “ACH speed guaranteed with no Alabama license proof”

- “Unlimited rollovers to avoid default”

- “Refinance every small payment into bigger principal”

If you see these lines, reset your path and use a vetted marketplace instead.

Borrower Budget Math Many Alabama Households Face

Durable monthly obligations literacy:

- Rent/Mortgage: 600–1,800 dollars/mo

- Utilities: 80–320 dollars/mo

- Transport: 120–450 dollars/mo + insurance binder spikes

- Food: 300–900 dollars/mo

- Medical: deductible or clinic bill waves

A lender should always preview Installments that do not break these essentials.

Previews for 2000 Dollar Loans Must Appear Internally First

Instead of layering scam domains or accepting external clicks to accept contract before seeing terms, request moderate emergencies at EasyFinance.com that internally compare lenders licensed for Alabama residents. If you want to learn from smaller deferred rails once for deposit literacy, Alabama borrowers browse clusters like tribal loan online smaller rails knowledge or payday loan online once early for deposit timing education. But all emergencies above 500 up to 2000 dollars must Always amortize or be personal classified credit from Alabama-licensed lending partners screened privately Through marketplace rails at EasyFinance.com For Alabama residents Early application success Without requiring dozens external form footprinted domains.

Hard Inquiry vs Soft Pull vs No Credit Check – Durable Alabama Differences

Durable distinction Many borrowers misread:

- No Credit Check Form Start: No FICO hard pull on initial form but still requires identity, deposits, income stability, and ability-to-pay math once cost preview rails appear internally digitally once before borrower signs or accepts.

- Soft Pull Partners: Non-hard inquiry check, still previews cost.

- Hard Inquiry: Impacts score, must be optional.

Alabama Borrower Protections That Help You Reach Payoff in Fewer Cycles

Real protections include:

- License requirement for Alabama

- Written cost + payoff schedule

- Maximum 500 deferred payday

- Installment pivot above 500

- No bank password asks

- No external acceptance clicks

Combine Awareness with Smart Marketplace Steps

Submit 1 secure request at EasyFinance.com for up to 2000 dollars. You can learn deposit literacy by reading same day loan clusters or preview structured rails like a 1,000 bad credit loan Once early. But final moderate emergencies for up to 2000 For Alabama households must amortize responsibly from Alabama licence Sponsors matched Only internally through marketplaces Like EasyFinance.com.

Key Insights

- Deferred payday stops at 500 principal.

- Emergencies up to 2000 must come from licensed partners

- Predatory loans hide cost and payoff tracks

- EasyFinance.com is safest path with internal matching

FAQ

-

Are tribal loans safe in Alabama?

They can be legitimate, but typically carry ultrahigh costs and avoid Alabama state protections. For emergencies above 500 up to 2000, AMLicensed installment or personal classified credit matched internally Only Through EasyFinance.com with cost preview rails once windshield internal digitally before borrower signs or accepts any contract once for Alabama residents.

-

Do upfront fees mean scam?

Yes. Especially gift card, wire, crypto.

-

Do lenders verify income?

Yes, real ones do.

-

Is EasyFinance.com a lender?

No. Marketplace only.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama