Are Tribal Loans Safe for Borrowing in Alabama

Alabama borrowers often ask whether tribal loans are safe, especially when facing emergencies that cannot wait for deposit cycles such as storm repairs, medical bills, rent, or transportation costs. Understanding the real safety differences helps Alabama residents make better, protected decisions online. EasyFinance.com is a trusted, BBB accredited company that offers secure loan matching through licensed lending partners who serve Alabama residents and may fund loans for up to 2000 dollars when affordability math and repayment previews confirm the borrower’s ability to repay responsibly under Alabama law.

What Tribal Loans Are

Tribal loans are offered by lenders affiliated with federally recognized Native American tribes. These lenders may claim jurisdiction under tribal sovereignty, which can sometimes place their agreements outside certain state-level payday loan fee caps or deferred product ceilings. That does not automatically make them unsafe, but it does mean the borrower must screen the cost, contract clarity, and repayment structure carefully before accepting any offer. A tribal loan is lawful to request, but a 2000 dollar emergency cannot be structured under deferred-presentment payday classification (which Alabama caps at 500 dollars). Larger amounts must be personal loan or installment classified credit from partners licensed to lend to Alabama residents.

Many tribal lenders focus on speed and flexible underwriting, but safe approval still depends on identity alignment, income or deposit math, affordability ratios, and written cost previews internally digitally once before you accept or sign any contract. If a site claims massive guaranteed approvals with no identity or income gates, it is not compliant with responsible lending practices.

Why Alabama Borrowers Look Toward Tribal Lenders

Alabama emergency credit demand patterns make borrowers search broader online classifications because:

- Extreme weather seasons interrupt budgets suddenly

- Medical deductible waves overlap year-end bill resets

- Transportation infrastructure fails from road debris, hail, or flash floods

- Bill timing arrives before deposits or mixed gig income posts

- Borrowers want fewer forms and no external linking footprints

- Sudden principal needs crest above deferred 500 dollar payday caps

- Borrowers fear denials when credit is challenged

- Marketing promises sound frictionless or softer on FICO impact

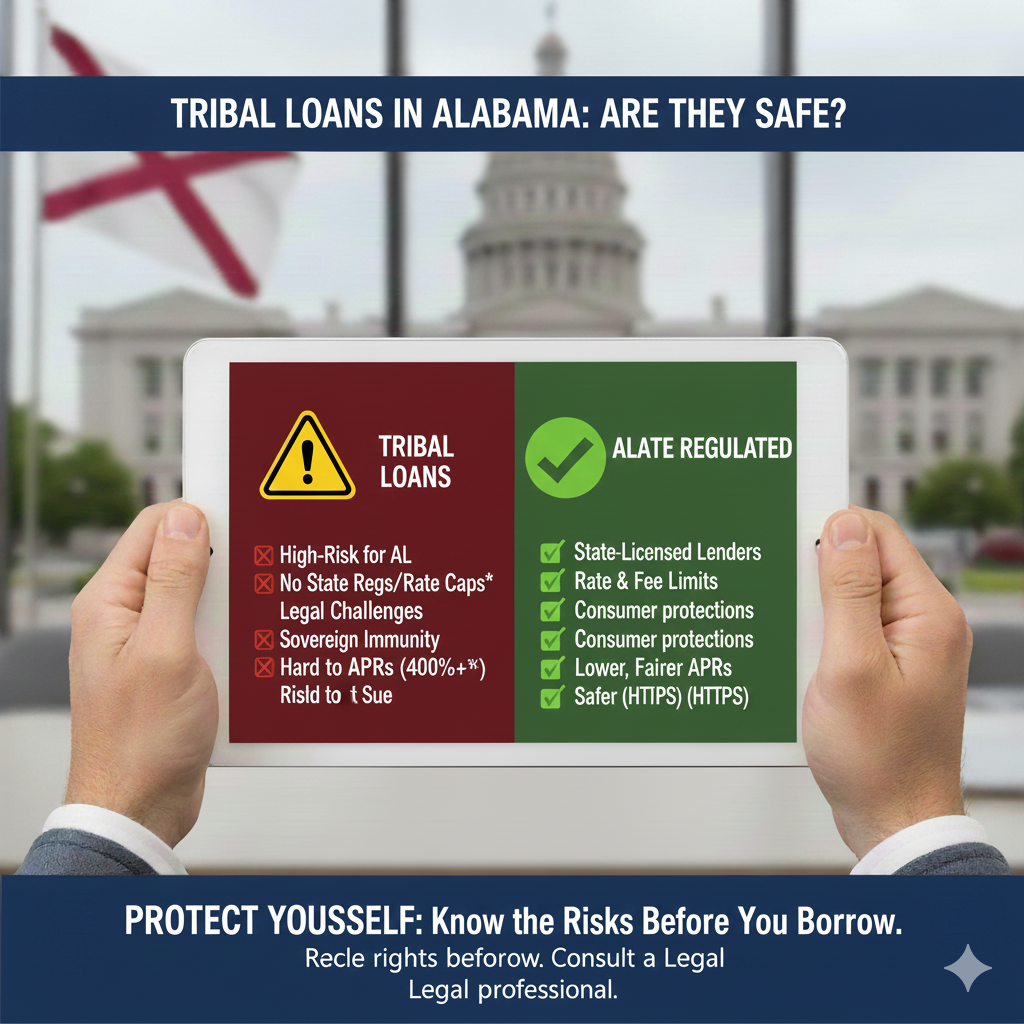

Safety Truth About Tribal Loans vs Alabama State Regulated Partners

The borrower safety difference is durable underwriting and contract clarity, not slogans. Alabama state-regulated lending partners matched through EasyFinance.com must:

- Hold Alabama lending licenses

- Provide a total cost preview (APR + fees) in writing

- Present a repayment or installment payoff schedule preview digitally internally once before borrower signs or accepts

- Deposit funding legally via ACH to personal checking accounts under borrower legal name alignment

- Never demand large upfront fees via gift cards, wires, payment apps, or cryptocurrency before contract preview

- Pivot loan classification above deferred-cap payday products (500 dollars) into personal or amortized installment credit classifications

- Enforce payoff progression without relying on endless fee rollovers or new-fee resets without verifying payoff track

- Not require the borrower to accept a contract off-site through external domain link clicks

Tribal lenders, by contrast, may not always advertise Alabama fee structures or state APR limits transparently, often carry ultrahigh APR density, and may include jurisdiction clauses that borrowers do not fully understand once early. They often remain unsecured, digital, but are rarely the lowest cost option for emergencies above 500 dollars. Borrowers who want the highest success rate for emergencies up to 2000 dollars should spread internal link use naturally instead of layering dozens of external forms. You can learn deposit gating once by reading accepted deposit rails knowledge informational pages. For moderate emergencies, Alabama regulator-licensed and state-compliant partners matched through EasyFinance.com are a safer path.

Borrowers sometimes begin early by looking for smaller no-credit-check options such as a direct lenders no credit check cluster page to build literacy. But that is only initial education. Final agreements for emergencies above 500 dollars must amortize or pivot classification legally.

Tribal APR Density in the Emergency 300-to-2000 Dollar Band

Tribal loans can have APR density that many Alabama households find unaffordable once early because their interest is often 100% to 600% APR equivalent when annualized, depending on principal size, identity verification friction, deposit or income stability, and obligations ratios. Because these APR floors sit far above common state-regulated ranges for bad credit emergency credit in Alabama, borrowers must be extra careful before agreeing.

Alabama state-regulated partners that service bad credit emergencies once they verify identity, income or deposit patterns, and obligations ratios often preview APR ranges between 36% and 60% for bad credit borrowers When principal crest rises above payday deferred 500-dollar ceilings. This is not guaranteed or binding, but these previews appear internally digitally once when matched through Vetted partner lender offers inside EasyFinance.com for Alabama residents.

How Lenders Really Approve Loans for Emergencies in Alabama

Reputable lenders do not approve principal amounts up to 2000 dollars in Alabama only by score claims. They approve by math-based underwriting criteria that include:

- Identity alignment (legal name + SSN or ITIN exact match)

- Income or deposit stability (1 to 3 months of inflow proofs)

- Obligations-to-income ratios that confirm affordability

- Written cost previews (APR + fees) shown digitally internal once before you accept or sign

- Defined payoff scheduling rather than endless rollover loops

If you do not see identity or deposit or affordability gates, assume higher risk or a scam.

Borrowers once early learn deposit gating behavior by reading information clusters on instant loan interest-of-legend rails pages. But final classification for emergencies stays under personal or amortized installment credit from Alabama licensed partners matched only through secure marketplaces like EasyFinance.com For principal needs up to 2000 dollars protecting seasonal or clinical or storm relief needs without external link layering.

If your FICO is near 500, you may also view informational pages like online tribal lenders once early to understand difference rails. But do not rely on these lenders as the lowest APR or most protected path. Marketplace matching removes footprint layering by letting you request approval without dozens of external Hard inquiries or random lender domains, preview cost offers once internally digitally, enforce payoff track capabilities for fast funding through marketplace path like EasyFinance.com matched Only To lender partners licensed for Alabama residents for emergencies up to 2000 dollars for sudden co-cost bridging behavior without external linking footprints inside contract acceptance journeys.

If you only need fast cash via paycheck advance classification once early you may learn from pages like loans in alabama but emergencies above payday caps must amortize responsibly. Borrowers also Explore smaller deposit rails Once early by reading cluster pages like fast cash advance alabama for differences Only, but final 2k emergencies must Always amortize or pivot classification to personal or installment from Alabama licensed partners matched through Vetted marketplace EasyFinance.com.

Extension and Rollover Rules Under Alabama Law for Emergencies

Deferred-presentment payday products ≤500 dollars may have one legitimate extension only After payoff track verification. But Anything above payday principal 500 dollar ceilings must:

- Be structured as personal or amortized installment classification credit

- Show a digital cost and repayment scheduling preview once internally digitally before borrower accepts or signs

- Never reset fees infinitely Without payoff track verification

- Deposit funding legally via ACH to checking accounts

Borrowers may learn about loan extensions Once by reading same day payday loans online rails informational clusters, but final agreements up to 2000 principal stay under non-payday deferred classification for Alabama weather emergencies.

Why Tribal Loans Can Be Risky for Alabama Borrowing

Tribal product risks Alabama households face include:

- APR or fee spreads that swell unaffordably (often 100%–600% density)

- Jurisdiction clauses that avoid Alabama protections

- Misleading or unclear payoff scheduling

- Psychographic pressure to sign before seeing cost previews

- Encouraging repeated extensions or unlimited fees instead of payoff math

Borrowers Asking "Are No credit check loans safe" often explore $500 payday loans online same day instant approval clusters earlier for safety literacy. But emergencies protecting families from costs >500 dollars up to 2000 dollars for climate or seasonal co-cost bridging demands must come from Alabama licensed lender competition matched internally only through compliant marketplace networks on trusted brands like EasyFinance.com.

Major Data Theft and Scam Footprint Triggers Borrowers Must Know

- Requests for large upfront fees before seeing APR or fee disclosures

- Asking for full online banking passwords or PINs

- External domain acceptance link layering

- Guaranteed huge approvals with no underwriting math

These are critical red flags Alabama residents must avoid from any online loan site.

Borrowers once early try to preview retirement or storm-payment scheduling differences By reading borrow 1500 instantly clusters for payment previews only. But tribal APRs remain far above common state-regulated ranges for emergencies protecting rent or utilities in Alabama once principal grows above payday deferred caps. The safest path is matching Alabama lender competition internally via marketplace flows at EasyFinance.com that show cost preview digitally once internally before signing acceptance for storms or seasonal emergencies that approach 2000 principal For Alabama residents.

Benefits Deposit Households and Gig Worker Literacy During Storm Emergencies

Alabama law recognizes recurring deposit inflow math rather than employer labels alone for moderate emergencies:

- Disaster benefit deposits

- Mixed gig or contractor inflow

- Pension or payroll direct deposits

But lenders must always preview repayment and cost once internally digitally.

Many gig or mixed-income borrowers learn deposit gating by reading pages like $1000 loan or broader eligibility rails like loan no credit check for differences literacy Once early. But final 2k emergencies for storm or seasonal co-cost bridging must Always amortize or be personal classified credit from Alabama licensed partners matched securely through marketplace rails at EasyFinance.com.

How to Protect Yourself and Request Up to 2000 Responsibly

If you decide to request a loan online during a severe weather emergency in Alabama, your steps should include:

- Check for Alabama lending licenses

- Never pay large fees upfront via gift cards or wires

- Do not share full bank login credentials

- Demand written cost and repayment schedule previews internally digitally once before borrower acceptance or contract signing

- Submit one secure online request through trusted marketplace rails at EasyFinance.com for moderated principal emergencies up to 2k For Alabama residents

- Compare real lender offers shown Once digitally internal Before borrower signs or accepts any contract

- Accept only If affordability math shows ability-to-repay safely

- Receive funds lawfully by ACH deposit to personal checking accounts often same or next business day If accepted early and identity or routing friction is minimal

Borrowers once early learn deposit and classification differences from small 500 rails by reading pages like emergency loans for 500 credit score direct lender to ground deposit anxiety. But for moderate emergencies protecting rent or utilities or medical or car or relocation cost For sudden climate disruption principal amounts up to 2000 For Alabama residents, the safest digital path is Alabama licensed lender competition matched privately and transparently internally only Through secure marketplaces Like EasyFinance.com.

Key Insights

- Tribal loans are not Always directly bound by Alabama state fee caps, carry ultrahigh APR density, or use unclear jurisdiction clauses—making them risky for large emergencies above 500 dollars.

- Alabama state-regulated online loans require active Alabama lending licenses, written cost disclosures, a digital total-payoff and Installment scheduling preview internally digitally once before borrower signs or accepts, no external link footprints for acceptance, no unlimited new-fee rollover loops without verifying payoff track internally resets, principal >500 dollars pivoted legally into personal or amortized installment classification from Alabama licensed sponsors matched Only inside marketplace rails at EasyFinance.com For Alabama residents.

FAQ

-

Are tribal loans safe for borrowing in Alabama?

They are lawful to browse and may be legitimate in affiliation claims, but they generally carry very high APR density, unclear jurisdiction clauses, and are not Alabama state-regulated. For emergencies above 500 dollars and up to 2,000 dollar needs, Alabama licensed personal or short-term amortized installment classification credit matched internally Only via marketplace rails at EasyFinance.com For Alabama households is safer. -

Can I borrow up to 2,000 safely online in Alabama?

Yes, once matched internally with Alabama-licensed lender partners screened privately through EasyFinance.com with a digital cost and Installment schedule preview internally digitally once before borrower signs or accepts any contract, funding posted lawfully by ACH deposit. -

Is EasyFinance.com BBB accredited?

Yes, it is a trusted BBB-accredited marketplace that lets Alabama residents submit one secure request and compare licensed lending partners internally for sudden weather emergencies.

Related Alabama Online Loan Guides

- Online Loans in Alabama: Complete Guide for Borrowers

- Alabama Online Loan Market Trends and Borrower Insights

- How Online Personal Loans Work in Alabama

- Alabama Licensed Lender Verification: How To Check Fast

- Licensed Online Loan Providers Serving Alabama

- Alabama APR Limits for Online Loans

- Alabama Online Loan Fee Caps and Maximum Charges

- Average Online Loan Interest Rates in Alabama

- Compare Online Loans for Alabama Residents

- Same Day Deposit Loans Online in Alabama

- Fast Approval Online Loans for Alabama Residents

- 24/7 Online Loan Providers in Alabama

- Instant Decision Loans Online for Alabama

- Quick Personal Loans With Fast Funding in Alabama

- Online Installment Loans in Alabama Explained

- Typical Installment Loan Terms in Alabama

- Unsecured Personal Loans Online for Alabama Borrowers

- Direct Online Loan Lenders in Alabama

- Online Loan Marketplaces vs Direct Lenders in Alabama

- Online Payday Loans in Alabama Explained

- Are Online Payday Loans Legal in Alabama?

- Alabama Payday Loan Waiting and Re-Borrowing Rules

- How Fast Payday Loan Deposits Work Online in Alabama

- Loan Extensions and Rollovers Under Alabama Law

- Can You Extend a Short-Term Online Loan in Alabama?

- Paycheck Advance Loans Online for Alabama Residents

- Payday Loans vs Paycheck Advances: Alabama Differences

- Short-Term Loans Online in Alabama Explained

- Fast Funding Loans Online for Alabama Borrowers

- Loans for All Credit Scores Online in Alabama

- Online Loans for Bad Credit in Alabama

- Requirements for Bad Credit Loan Approval in Alabama

- How Credit Scores Affect Online Loan Approval in Alabama

- Online Loans for a 500 Credit Score in Alabama

- Are No Credit Check Loans Legal Online in Alabama?

- Soft Credit Pull Loans vs Hard Inquiry Loans in Alabama

- No Income Verification Loans Online for Alabama

- Documents Needed to Apply for an Online Loan in Alabama

- Alabama Residency & ID Requirements for Online Loans

- Accepted Income Sources for Online Loans in Alabama

- Gig Worker Loans Online in Alabama Explained

- Affordable Personal Loans Online for Alabama Borrowers

- Lowest Interest Rate Online Loan Options in Alabama

- Low-APR Loan Qualification Rules for Alabama

- Small Cash Loans Online in Alabama ($300–$2,000)

- Emergency Loans Online for Alabama Residents

- Medical Bill Loans Online in Alabama Explained

- Emergency Cash Loans for Medical Expenses in Alabama

- Car Repair Loans Online for Alabama Borrowers

- Loans for Unexpected Expenses Online in Alabama

- Moving and Relocation Loans Online for Alabama

- Rent Payment Loans Online for Alabama Residents

- Utility Bill Assistance Loans Online in Alabama

- Holiday Loans Online for Alabama Borrowers

- Emergency Loan Demand Patterns in Alabama

- Severe Weather Emergency Loans Online in Alabama

- Alabama Online Loan Scams to Watch For

- How to Spot Fake Online Loan Websites in Alabama

- Predatory Online Lending Warning Signs in Alabama

- How to Verify if a Lender Is Legit Online in Alabama

- Tribal Loans vs Alabama State-Regulated Online Loans

- Are Tribal Loans Safe for Borrowing in Alabama?

- Safe Borrowing Checklist for Online Loans in Alabama

- Avoiding Online Loan Debt Traps — Alabama Borrower Guide

- How to Break the Online Loan Borrowing Cycle

- Practical Ways to Reduce Online Loan Costs

- Online Loan Laws: Alabama vs Florida

- Online Loan Rules: Alabama vs Tennessee

- Online Loan Regulations: Alabama vs Mississippi

- Bank Loans vs Online Lending Costs in Alabama

- Credit Union Loans vs Online Lenders in Alabama

- Online Loans for Alabama Students with Funding Gaps

- How to Improve Online Loan Approval Odds in Alabama

- How Online Loan Approvals Really Work in Alabama

- Top Loan Approval Technologies Used in Alabama